Quick Thoughts on Powell's Jackson Hole Remarks: As Expected

After the post-July FOMC meeting remarks and the subsequent minutes Chair Powell's address did not contain news: easing starts in September and will be gradual.

Chair Powell’s address at the 2024 Jackson Hole meeting really confirmed what recent FOMC meeting minutes and public remarks already had signaled: the Fed will start a rate cutting cycle in September, with the intention of pursuing a gradual easing path.

Key takeaways:

The Fed has shifted from an almost singular focus on inflation towards managing risks to both the inflation and employment sides of its mandate.

Given recent inflation easing and an increasingly cooler labor market, the Fed will start cutting policy rates starting at the upcoming September FOMC meeting.

In terms of the rate cutting pace, the Fed’s intention is cut rates gradually given still above-target inflation, the importance of preserving stable inflation expectations and the expectation that labor markets are cooling and not deteriorating.

The end point of the forthcoming easing cycle will likely also end up somewhat higher compared to the immediate pre-COVID years given a higher neutral rate.

Near-term Outlook

Chair Powell confirmed that progress on inflation was deemed to be satisfactory and the cooling the labor market has taken it out as a meaningful source of upward inflationary pressures. As such this has allowed the Fed to become more attuned to both sides of its mandate and start managing risks to employment as well.

After a pause earlier this year, progress toward our 2 percent objective has resumed. My confidence has grown that inflation is on a sustainable path back to 2 percent.

[…]

Today, the labor market has cooled considerably from its formerly overheated state. The unemployment rate began to rise over a year ago and is now at 4.3 percent […]. Most of that increase has come over the past six months. So far, rising unemployment has not been the result of elevated layoffs, as is typically the case in an economic downturn. Rather, the increase mainly reflects a substantial increase in the supply of workers and a slowdown from the previously frantic pace of hiring. […] All told, labor market conditions are now less tight than just before the pandemic in 2019—a year when inflation ran below 2 percent. It seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon. We do not seek or welcome further cooling in labor market conditions.

[…] The upside risks to inflation have diminished. And the downside risks to employment have increased. As we highlighted in our last FOMC statement, we are attentive to the risks to both sides of our dual mandate.

“Review and Outlook”, Powell, J.H., August 23, 2024

Given that background it is clear the Fed now can start dialing back restrictiveness gradually while keeping an eye on the evolving inflation and labor market data.

The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.

We will do everything we can to support a strong labor market as we make further progress toward price stability. With an appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labor market. The current level of our policy rate gives us ample room to respond to any risks we may face, including the risk of unwelcome further weakening in labor market conditions.

“Review and Outlook”, Powell, J.H., August 23, 2024

In summary, here Chair Powell pretty much confirms what he and his colleagues already had signaled in the post-meeting statement and press conference after the July FOMC meeting as well as in the minutes of that meeting.

How Did We Get Here

Chair Powell’s speech also contained an honest and to the point assessment of rise and relative easing of inflation over the past two-to-three years, as driven by a combination of excessive demand and constrained supply:

This narrative attributes much of the increase in inflation to an extraordinary collision between overheated and temporarily distorted demand and constrained supply. While researchers differ in their approaches and, to some extent, in their conclusions, a consensus seems to be emerging, which I see as attributing most of the rise in inflation to this collision.

“Review and Outlook”, Powell, J.H., August 23, 2024

One interesting consequence of this analysis, not mentioned by Chair Powell, is that while “overheated and temporarily distorted demand” in itself can be dealt with higher policy rates, a constrained supply might well require higher (real) neutral rates going forward. Certainly, a variety of model- and market-implied measures of real neutral rates have been suggesting that this indeed likely will be the case (chart above). This, in turn, suggests a relatively higher end point for policy rates in the forthcoming easing cycle.

Also noteworthy was a strong emphasis on anchored inflation expectations as a facilitator of a relatively painless disinflation after the inflation peaks of 2022:

All told, the healing from pandemic distortions, our efforts to moderate aggregate demand, and the anchoring of expectations have worked together to put inflation on what increasingly appears to be a sustainable path to our 2 percent objective.

Disinflation while preserving labor market strength is only possible with anchored inflation expectations, which reflect the public's confidence that the central bank will bring about 2 percent inflation over time.

“Review and Outlook”, Powell, J.H., August 23, 2024

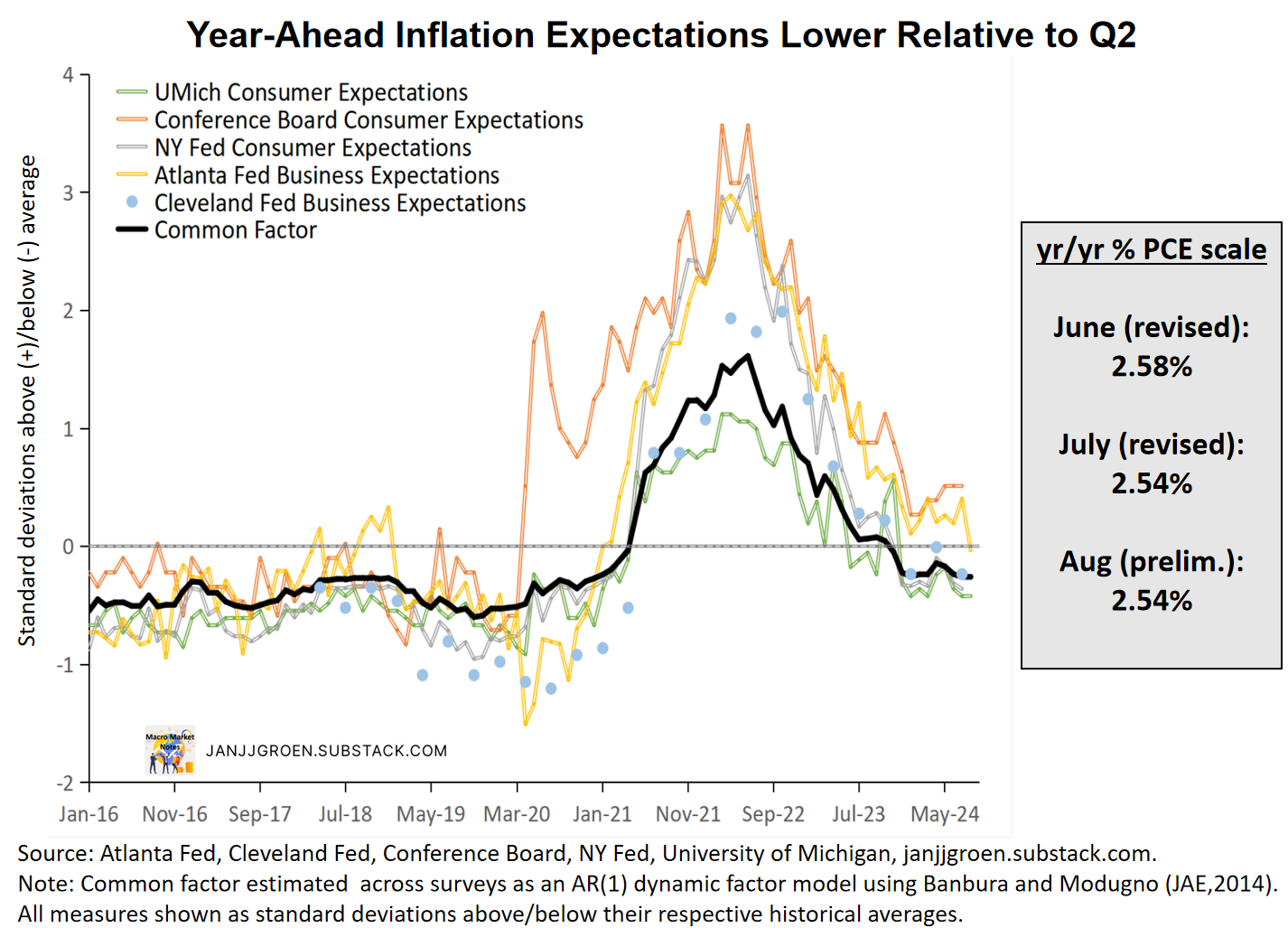

Indeed, while the re-firming of inflation earlier led to an acceleration of firms’ and household inflation expectations, as shown by the common trend across a variety of surveys in the chart above, they have since then eased towards levels not seen since late 2020 albeit still above 2%.1 No doubt this has given the Fed additional confidence that policy restrictiveness now can be dialed back.

However, this also suggests that bumps along the way (in terms of inflation data) could adversely impact those inflation expectations, which can give this Fed pause when cutting rates. And this again indicates that the forthcoming rate cutting cycle is intended to be a gradual one, where “[…] dialing back a little bit of restrictiveness is what most policymakers are aiming for.”, while the Fed still will have enough ammunition to deal with downside risks should these materialize.

This estimate of the common trend across firms’ and households’ inflation expectation surveys, incorporates the preliminary August University of Michigan survey as well as the August Atlanta Fed Business Inflation Expectations survey.