Dog Days of August: July CPI & Retail Sales and Claims

The July CPI report likely allows Fed policy easing in September. However, strong initial spending and labor market data point to shallow policy easing ahead.

As Fed Chair Powell gears up for his annual address at the Jackson Hole conference next week and some data pointing to possible economic weakness, this note reviews trends from the most notable data releases this week: the July CPI and Retail Sales reports as well as the weekly jobless claims data.

July CPI: Neither Here Nor There

The topline numbers of the July CPI report came pretty much in line with consensus expectations. Headline CPI rebounded to 0.2% over the month in July, after declining 0.1% in June, whereas core CPI inflation was up 0.2% m/m (two-digits: +0.16%, a 10-basis point acceleration relative to June).

A big driver behind both this and previous reports remained the CPI Rent of Shelter component (OER+Rent), which slowed notably in June and picked up again in July: from 0.2% month/month to 0.3%. CPI OER inflation has been volatile across regions in May and June, with unusual strong CPI OER in the Northeast in May and weakness in June in the West. This reverted in July with other regions remaining stable in the 0.3%-0.4% month/month range (chart above). So, the start of the highly anticipated downtrend in the most dominant component of CPI, CPI OER, remains elusive (chart below).

To get a feel of real underlying CPI inflation, one can look at the Cleveland Fed's trimmed mean CPI measures, which cast away excess volatile elements by either taking the median (price change of the CPI component at the 50th percentile across all price changes) or a 16% trimmed mean (weighted average of price changes once both the top 8th percentile and lowest 8th percentile of price changes are deleted). The Median CPI measure accelerated from 0.2% month/month to 0.3% in July, and the 16% Trimmed Mean CPI measure grew at the same pace as in June: 0.2% month/month.

Since the June FOMC meeting public remarks by Fed officials have made clear the Fed wants to see sustained inflation progress over several months to quarters before embarking on rate cuts. I have interpreted that as the six-month average of underlying PCE inflation rates reaching 2.5% or less.

Underlying CPI inflation series are still overshooting the Fed's 2% inflation target over a six-month period, but they have eased nonetheless (chart above). When using the strong correlation between these underlying CPI and PCE inflation series, statistical nowcasts of Median and Trimmed Mean PCE inflation, which are published later this month, suggest some underlying PCE inflation trend measures will have approached 2.5% on a six-month basis in July (diamonds in the chart above), signaling sustained inflation progress on some metrics but not all.

July Retail Sales: Goods Consumption Remained Strong

Retail trade (i.e. retail sales pertaining to goods) went up 1% over the month in July, a bigger increase than the consensus expectation. As always, it's crucial to remember to not take these figures at face value without looking under the hood:

Retail sales measures spending on goods as well as bar/restaurants spending. Thus, it really mostly measures goods consumption which is a relatively small slice of the monthly consumption basket, as about 2/3 of U.S. consumption expenditures relates to services.

Retail sales data does not correct for changes in prices, which for goods in particular can make a big impact: core goods prices in the July CPI report dropped 0.1% month/month. As such less strong retail sales growth could merely reflect more moderate price increases while retail sales volumes were still growing.

Merely deflating retail sales with CPI or core CPI overlooks the predominantly goods-focused nature of retail spending.

Dissecting retail trade data into subcomponents and aligning them with corresponding CPI subcomponents provides a more accurate assessment. Firstly, when it comes to retail trade data (that is, retail sales minus nominal bar and restaurant spending) I use the CPI Commodities, CPI Gasoline, CPI New & Used Vehicles and CPI Motor Vehicle Parts & Equipment indices to inflation adjust over retail trade as well as components related to sales at gasoline stations and motor vehicle dealers & parts. In case of bar and restaurant spending I deflate that component by means of the CPI Food Away from Home index.

Furthermore, I apply chain-weighting based on the Fisher index approach using current period and previous period prices and quantities of retail trade and the gas and motor vehicle components to parse out the impact of the latter two volatile components. This approach allows for time-varying weights, as prices and quantities change from period to period and consumers substitute between the different spending categories. It is the same methodology used to compute real consumption and GDP.

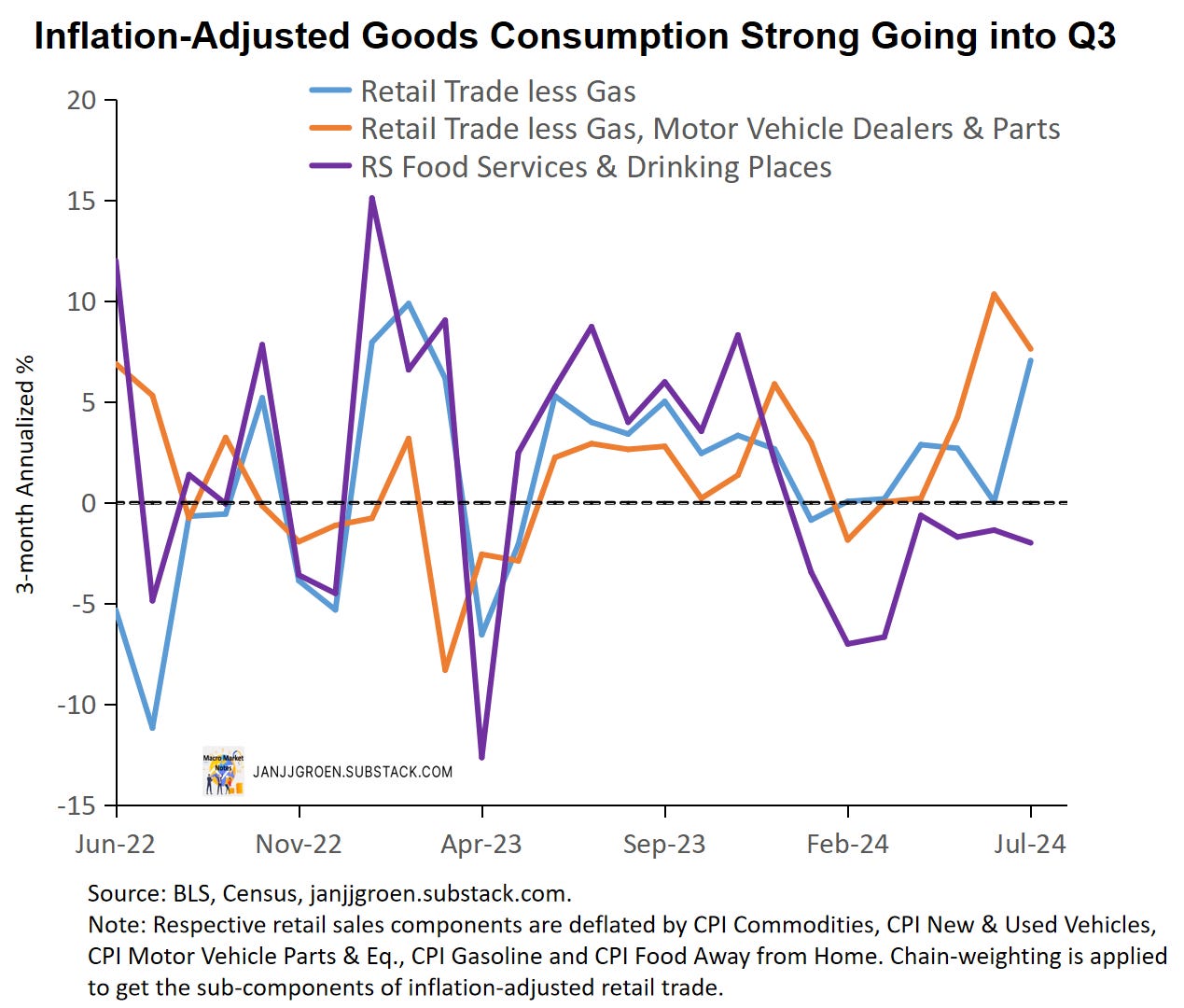

Core goods spending have improved notably on a three-month basis, as is evident from the chart above. In June there were large scale computer problems at car dealerships in the U.S., which were estimated to have led to at least a 2.6% year/year decline in vehicle sales. With these problems resolved, vehicle sales in July sharply rose as payback for the IT problems in June.

Outside of the vehicle sales, core goods spending excluding motor vehicles eased somewhat in July (orange line in the chart above). However, these continued to grow at the second highest pace seen over the past two years. Bar and restaurant spending remained downbeat in inflation-adjusted terms, but nonetheless is in much better shape compared to Q1.

So, we continue to see strong real retail spending activity on goods, with improving bar & restaurant spending likely reflecting of a consumer that is gaining in confidence. This bodes well for inflation-adjusted spending growth in the more complete July PCE report that will come out later this month. As I observed in the context of the June PCE report consumption growth was below trend in Q1 and going into Q2 accelerated back above its underlying growth rate. Today's data suggests that overall real consumption growth likely remained above trend in July.

Recent Trends in Jobless Claims

I usually do not write much about the weekly jobless claims data but with Jackson Hole coming up next week, these data are the most up to date data we currently have on the labor market and the state of the labor market has become more of a focal point for the Fed.

Dealing with seasonality in high frequency data is a complex issue, where seasonal patterns can easily shift from year to year and the pandemic has made this more complicated. I therefore focus on non-seasonally adjusted data and compare today’s data with data from previous years in the same week. The chart above indicates that initial claims peaked at a recent history high in July, likely reflecting the increase in temporary layoffs in the July jobs report, but then eased. Nonetheless, these remained relatively elevated around 2017 levels, higher than what we observed in 2019.

We have seen a relatively strong increase in the labor force over the past year, amongst others owing to higher immigration, and it has been noted that this increase in the labor supply has been a main driver behind the rise in unemployment. To correct for these effects, I look at the number of initial claims as percentage of employed persons that are covered by unemployment insurance in the chart above. Indeed, these corrected initial claims data suggest that the peak back in July was relatively muted compared to the recent past and since then dropped back in line with what we’ve seen in 2019 and 2022. So, labor force corrected layoffs remain very low.

Finally, we have seen continued jobless claims rise this year likely reflecting the drop in job-finding rates in the U.S. economy, i.e. once unemployed it has become harder this year to find a new job in a timely manner. Again, it is useful to correct for the rise in labor supply over the past year or so, and I do that in the chart above. In Q2 and beyond labor force-corrected continued claims have been in line with patterns seen last year as well as in 2018. This suggests we currently have relatively more longer term unemployed than in 2019 and 2022, but far less than in 2017. It therefore appears that current unemployment levels are not yet at levels that would overly burden the economy.

Takeaways

In of itself the July CPI report showed some additional easing of inflation, which if sustained in the forthcoming July Personal Income & Outlays report could be quantified by the Fed as satisfactory enough to start cutting rates in September. But it was inconclusive on whether the progress is sustained enough for the Fed's liking to warrant substantial policy rate easing, i.e. 25-basis points cut vs. 50-basis points cut.

The pace of labor market cooling and household spending will likely weigh more in this decision, and the recent releases on retails sales and jobless claims suggest an economy that is not in a recession and, for now, experiences labor market cooling rather than deterioration. Going into next week’s Jackson Hole speech by the Fed Chair, I do not expect Chair Powell to deviate much from his remarks post-July FOMC meeting with him emphasizing the good progress on inflation and a return towards a two-sided focus on price stability and employment instead of a “singular focus” on inflation. Baring a disastrous August jobs report on September 6th that will set us up for a 25-basis point rate cut at the September FOMC meeting and a broadly similar 2024 Fed funds rate path projection in the SEP update.