June 2025 FOMC Meeting Postmortem

The Fed kept rates on hold. The statement, updated forecasts and press conference suggests that policy easing is unlikely this year.

As expected, the FOMC kept the Fed funds rate target range unchanged at 4.25%-4.50% and it used the post-meeting forecast updates to signal it continues to project the economy to be in stagflation mode this year. We likely will have no rate cuts this year and we might see the Fed publicly committing to that at its September FOMC meeting.

Key takeaways:

The FOMC kept the Fed funds target range unchanged at 4.25%-4.50%. The pace of reductions of the Fed’s holdings of Treasury and mortgage-backed securities also remained unchanged.

The statement following the meeting continues to acknowledge elevated uncertainty as a factor impacting the economic environment.

Many FOMC members shifted their outlook and see even higher inflation path for this year (and in 2026) than back in March. A larger fraction of FOMC members than in March is favoring keeping policy rates on hold this year.

After today’s meeting I continue to expect unchanged policy rates for 2025.

Decision, Post-Meeting Statement and Post-Meeting Press Conference

As expected, the FOMC decided for the fourth consecutive month to keep the Fed funds rate target range unchanged at 4.25%-4.50%. The post-meeting statement continues to acknowledge elevated policy uncertainty as a factor affecting the economic environment:

Although swings in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate

has stabilized at a low level in recent monthsremains low, and labor market conditions remain solid. Inflation remains somewhat elevated.The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic outlook

has increased furtherhas diminished but remains elevated. The Committee is attentive to the risks to both sides of its dual mandateand judges that the risks of higher unemployment and higher inflation have risen.In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Susan M. Collins; Lisa D. Cook; Austan D. Goolsbee; Philip N. Jefferson;

Neel Kashkari;Adriana D. Kugler; Alberto G. Musalem; Jeffrey R. Schmid; and Christopher J. Waller.Neel Kashkari voted as an alternate member at this meeting.FOMC Statement, June 18, 2025 (with annotations relative to the May FOMC statement).

Chair Powell’s remarks at the post-meeting press conference really sang the same tune as at previous meetings this year: the labor market remains relatively stable with GDP growth slowing and inflation likely to accelerate further. Uncertainty, he stated, had peaked but remains historically elevated and this will continue to affect the Fed’s rate setting behavior. He also warned that actions from the Trump administration in terms of tariffs, immigration, fiscal policy and deregulation will take time to impact the economy, say more patient Fed behavior would be appropriate.

The Fed’s Own View

FOMC members updated their forecasts for inflation, growth the unemployment rate and the Fed funds rate at this meeting. The inflation outlook was again modified notably; the median 2025 Q4/Q4 core PCE inflation projection was upgraded from 2.8% previously to 3.1%. Given, as I’ll discuss this later, the 2025 outlook for the Fed funds rate did not change (at least in the median) I found this large core inflation upgrade surprising (I expected less of a change). Beyond 2025 the Q4/Q4 core PCE inflation projections also were revised up (as expected), with core PCE inflation going up from 2.2% to 2.4% for 2026. This is in line with Chair Powell’s remarks that the Fed sees a lot of uncertainty about how long it takes for the tariff hike impacts to played out in the inflation data.

The SEP projections for the unemployment rate for 2025 and 2026 went up somewhat compared to March and for both years not read 4.5%. It does signal that the Fed is willing to tolerate a prolonged, gradual drift up in the unemployment rate before it’d feel compelled to move down from current policy rate levels.

The median Fed funds projections for 2025 did not change in this SEP update, implying 50bps worth of rate cuts this year. This, again, aligns well with Chair Powell’s usual “looking through tariff hikes” spiel at the post-meeting press conference: the stagflation that likely will occur in 2025 will be limited to this year and thus the Fed can continue along its previously laid out path.

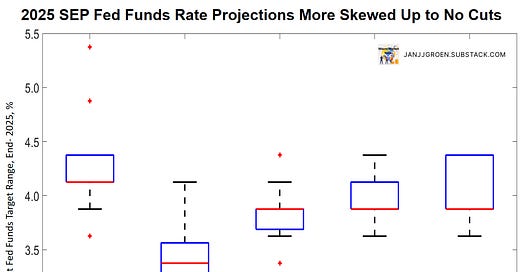

But the underlying distribution of individual FOMC members’ policy rate projections provide a different perspective. The chart above presents box-whisker plots of these distributions for the last couple of SEP updates. Since the September rate cut, this 2025 Fed funds rate distribution has been shifting up as the labor market panic of the summer of 2024 faded.

Relative to the March SEP, the median 2025 Fed funds rate projection remained unchanged in the current SEP, reflecting two rate cuts this year, but the distribution shifted up significantly with more FOMC members penciling no cuts in 2025 vs. one or two cuts in the previous SEP. This in itself makes sense, as a lot more FOMC members at the same time are now expecting 2025 core PCE inflation to be a lot higher than last time. The continued upward skew in the underlying distribution of FOMC members’ Fed funds rate projections suggest to me that once the tariff-induced inflation acceleration starts to materialize we will not see any rate cuts by the Fed this year.

The Fed’s SEP also provides a clue about the range of views within the FOMC on R*, using the central tendency for the longer run Fed funds rate and PCE inflation, respectively. The chart above suggests that compared to March the distribution of FOMC members’ own assessment of the neutral real rate remained unchanged, with the median at 1%.

The chart above contrasts my updated surveys-based one-year real rate relative to the average and median of model- and market-implied R* estimates with a proxy of the Fed’s view on this real rate gap using information from its own SEP. This chart suggests that since the March FOMC meeting FOMC members’ policy stance expectations have shifted down somewhat (owing to higher expected 2025 inflation) but remains centered around neutral. The market, however, perceives the stance to more accommodative over the next twelve months, which suggests an expected unwillingness of the Fed to lean fully against rising inflation expectations. I don’t necessarily agree with that, but it is reflective of a communication issue this Fed has had since the inflation acceleration of 2021-2022.

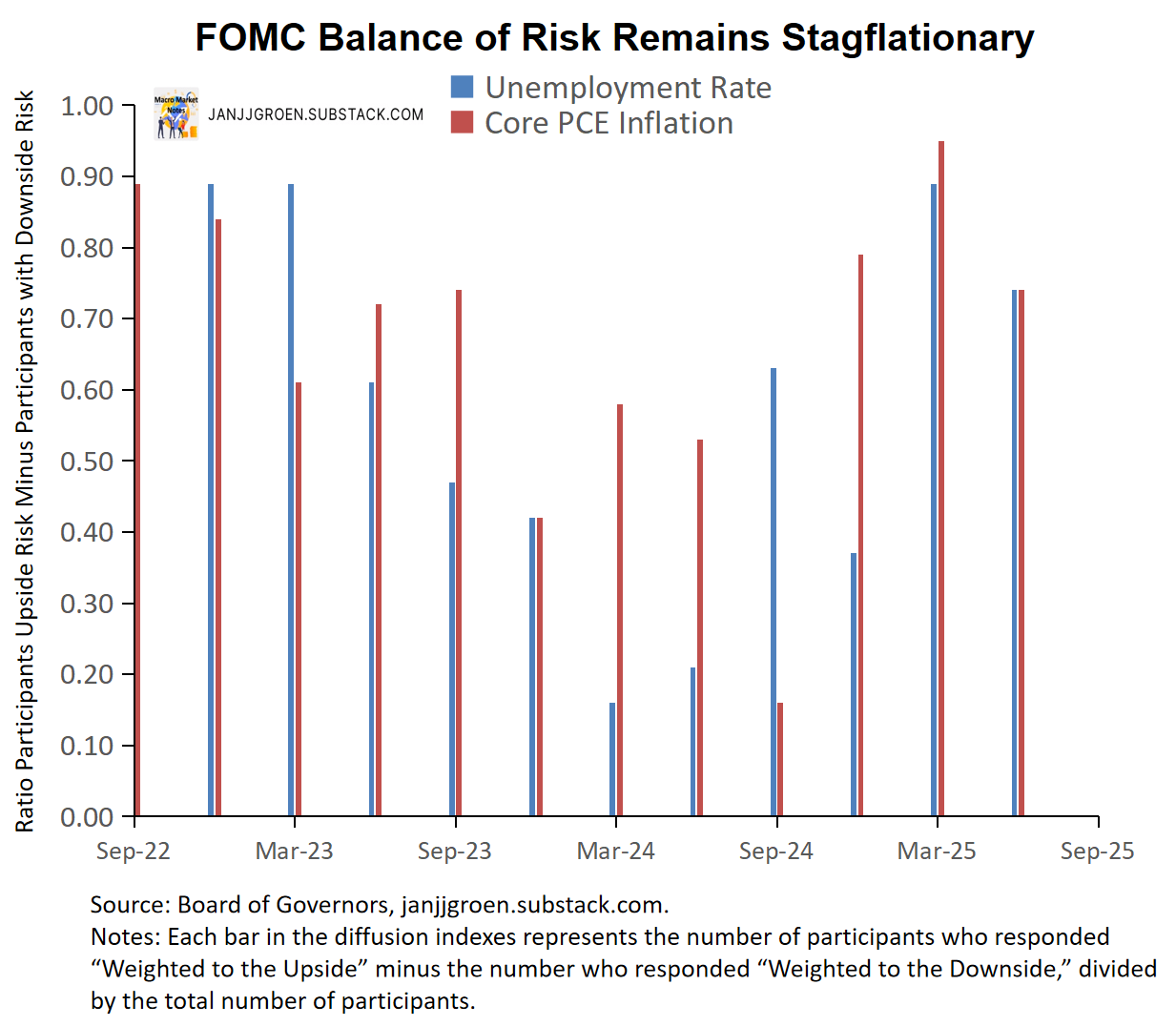

Beyond Today’s Meeting

In the March SEP the diffusion indices for both the unemployment and core inflation weightings rose notably to a level not seen since the March 2023 FOMC meeting (chart above). In today’s SEP update both risk weightings declined relative to March but remained elevated at levels not seen since mid-2023, with similar risk weightings for the unemployment rate and core PCE inflation. Interestingly, the central tendency of the Q4/Q4 2025 core PCE inflation projection shifted up more significantly than for the 2025 unemployment rate: 2.7%-3% → 2.9%-3.4% vs. 4.3%-4.4% → 4.4%-4.5%, and similarly for 2026: 2.1%-2.4% → 2.3%-2.7% vs. 4.2%-4.5% → 4.3%-4.6%. The Fed continues to see stagflation risks around its outlook with inflation uncertainty especially an issue for FOMC members.

As can be seen in the chart above, the above discussed shift in the FOMC’s 2025 core PCE inflation projections put the 2025 year/year path now implies an even worser overshoot relative to the Fed’s 2% PCE inflation target than in the March SEP. After five years of overshooting its 2% inflation target the Fed now projects that this year it will even fall behind more relative to achieving 2% inflation.

The year/year core PCE inflation path implied by the June SEP suggests that the average month/month core inflation rate for June-December 2025 should be about 0.3%. The chart above indicates that this should result in a significant acceleration in the year/year core inflation rate over the summer as well as towards the end of the year. It would breach 3% by November and reach 3.3% by year-end.

The chart above also suggests that a differentiation between the 2025 core inflation path implied by the current SEP and those with an average month/month rate in line with 2024 would already become more apparent in the July data (with 2.8% year/year core PCE inflation based on the current SEP and 2.6% based on a 2024 path). The September FOMC meeting therefore is where the Fed most likely will publicly take rate cuts off the table for this year.

To summarize:

The Fed continues to expect stagflation to be a feature of the U.S. economy in 2025.

Digging into the distribution of Fed funds rate projections of individual FOMC members, an increasing number of members do not scope for rate cuts in 2025 owing to this stagflation. My modal outlook for 2025 remains for no rates with a Fed funds target in the 4%-4.25% range.

The July inflation data could give clues whether the currently projected overshoot of the inflation target in the Fed’s 2025 Q4/Q4 core PCE forecast is coming into fruition. This likely means that the Fed will publicly take rate cuts off the table for this year at its September FOMC meeting.