On Wages and Inflation Expectations, Part Deux

Household Wage Income Growth Has Become Supportive of Above 2% Inflation Expectations

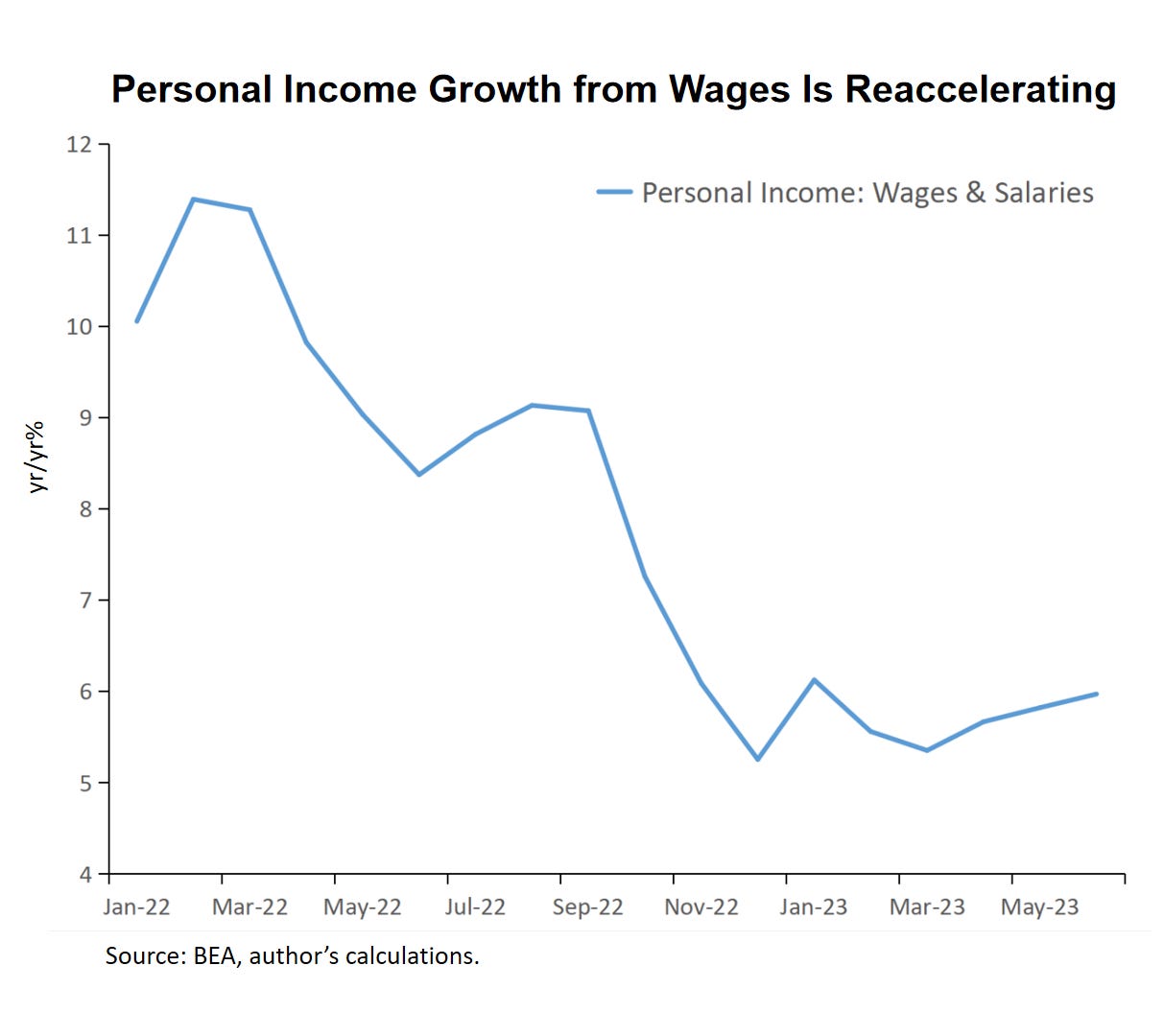

This note is a follow up from yesterday’s note on wage growth and inflation expectations. It is motivated by something that I noticed in today’s release of the BEA’s June Personal Income & Outlays report: income from wages and salaries accelerated to 6% year/year in June from 5.8% in May. In fact, this wage income growth rate has been on an upward trend since the end of 2022, as can be seen in the chart below.

So how to interpret this development? In this note I adapt my W* approach to attempt such an interpretation.

Adapting W* for Household Wage Income Growth

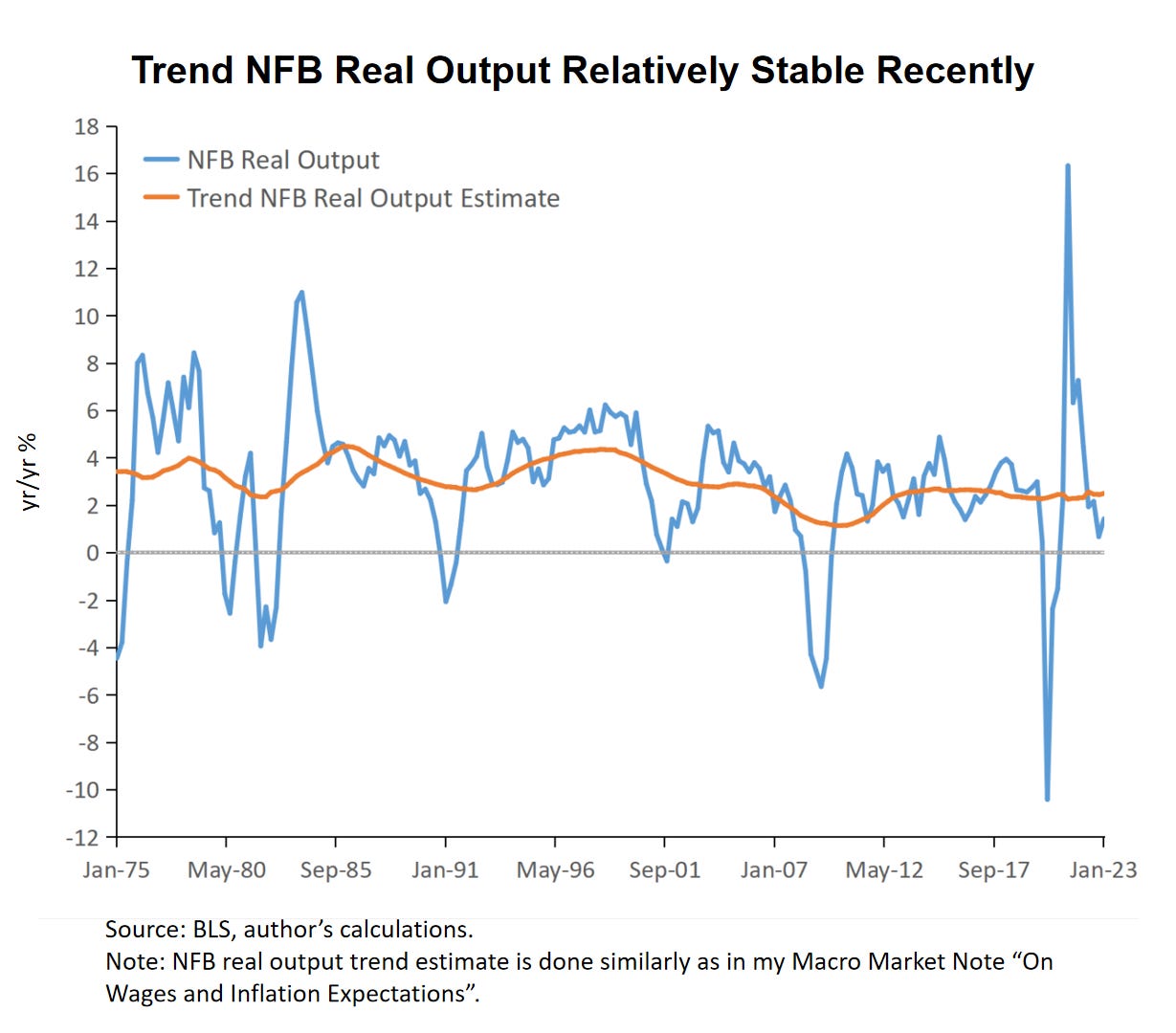

The focus of yesterday’s note was on interpreting measures of average hourly earnings. Personal income growth stemming from wages and salaries reflects growth in total wage income growth of households, which is a function of total hours worked. So, to get to a “neutral” level of household wage income growth we need to combine a measure of inflation expectations with the underlying trend growth of the total amount of output that households are producing. One of the components that make up the labor productivity metric from the BLS’ “Productivity and Costs” report I used previously is real output produced in the non-farm business (NFB) sector. Within the context of the current analysis, the intuition is that in the end expected real wage income growth should not structurally outpace trend real NFB output growth.

Using the approach from yesterday’s note I can estimate the trend NFB real output growth, and I plot the resulting measure in the chart below. In contrast to trend labor productivity growth, trend output growth has been relatively stable recently, which suggests that employment growth has been a compensating factor for the recent decline in trend labor productivity growth.

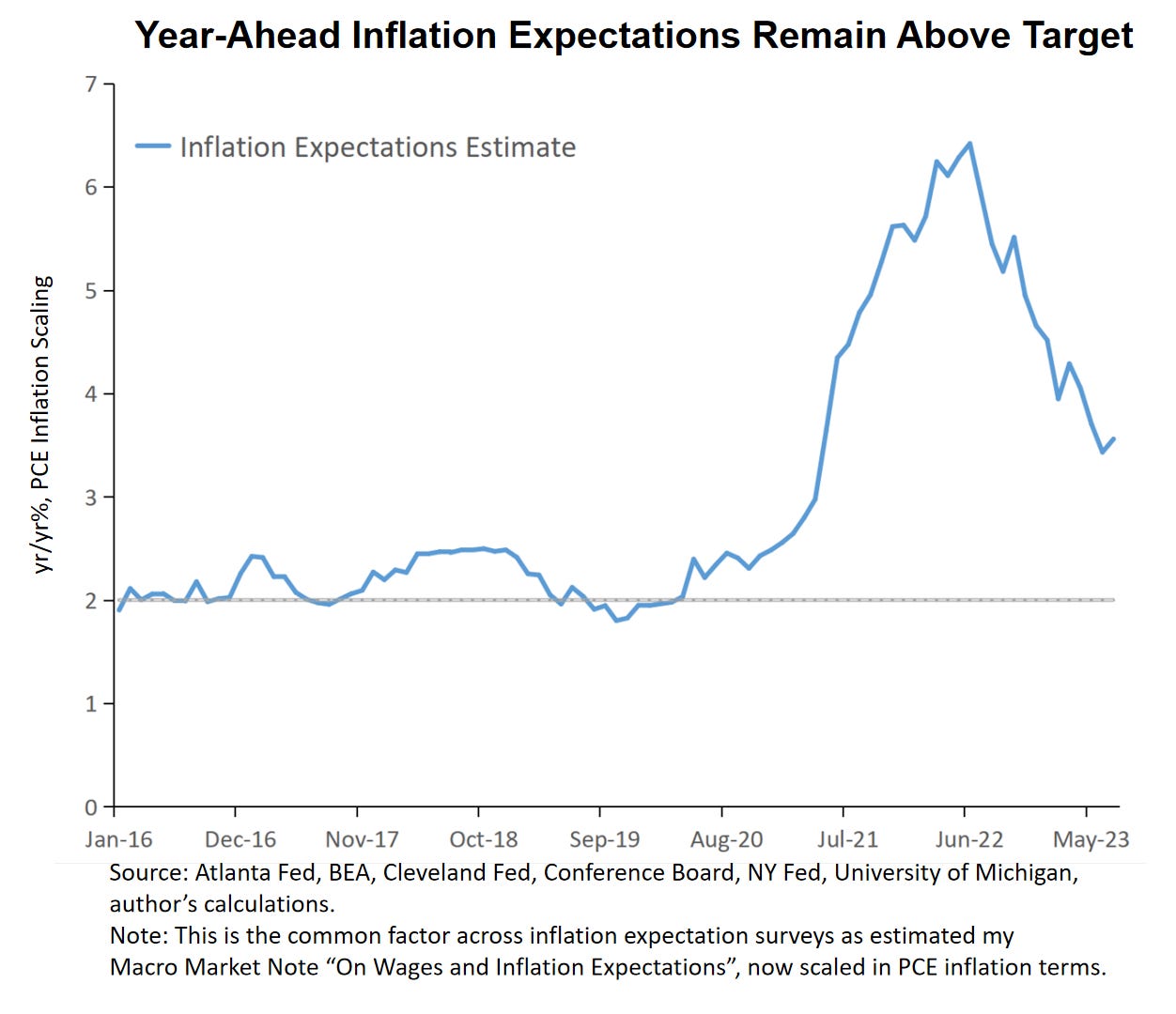

It is worth remembering that in the earlier note I estimated a measure of year ahead inflation expectations from a range of consumer and business expectations surveys, the result of which I depict in the chart below as a refresher for the reader. It does show that inflation expectations have eased but remain at above-target levels.

Household Wage Income Growth Supports Above 2% Inflation

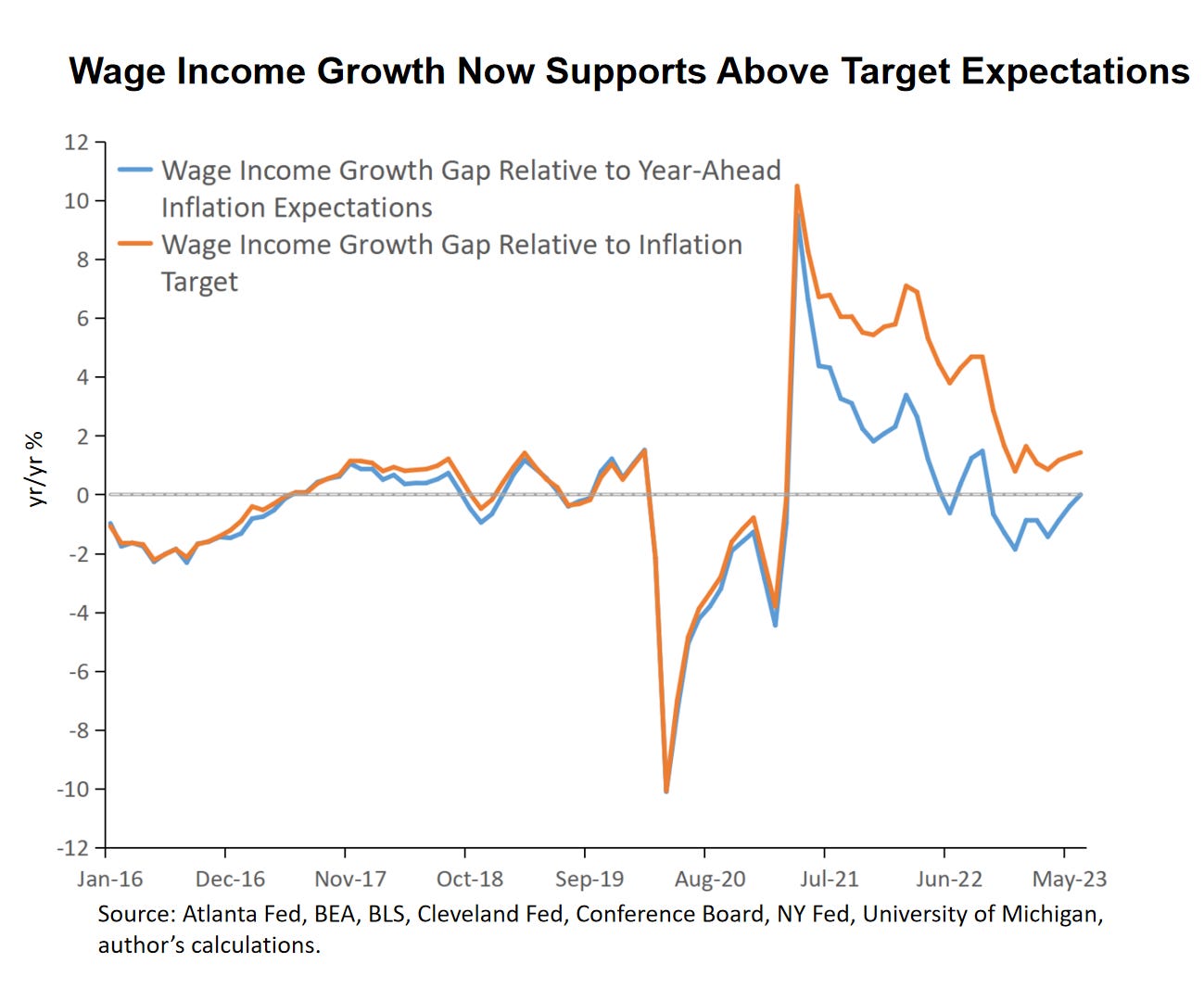

Summing the two measures in the second and third chart above gives a neutral benchmark for household wage income growth that could support over the medium-term the current level of inflation expectations as embedded in that benchmark. And, of course, I can also construct such a benchmark using the 2% inflation target instead of year ahead inflation expectations.

The final chart below reports on the gap between year/year growth of personal income from wages and the neutral benchmark growth rates based on year-ahead inflation expectations as well as the Fed’s 2% inflation target. A zero value means that household wage growth is over the medium term in line with the corresponding inflation expectations or inflation target.

The chart above suggests that towards the end of 2022 household wage income growth fell short compared to what was needed to sustain inflation expectations at levels north of 4% PCE inflation. Since the Spring, however, this gap has closed, and the current pace of household wage income growth is now consistent with 3.5% PCE inflation for the year ahead (see also the third chart). In terms of the 2% inflation target, however, household wage income growth rates have since early 2021 been consistently running at higher paces than those that would have been durably consistent with this target. And this did not change in the most recent June Personal Income and Outlays report.

The closure of the household wage income growth gap based on above-target inflation expectations came about despite the recent easing in average hourly wage growth. Continued strong employment growth combined with still elevated hourly wage growth rates appears to keep upward pressure on the wages and salaries part of household income. This in turn should keep consumption spending on a solid footing for now, resulting in a continued upside risk for, in particular, the core services inflation outlook.