Dog Days of August II: Payrolls Revisions and Minutes

Preliminary CES Benchmark revisions were more downbeat on 2023 job growth but more hopeful for 2024. The July FOMC minutes signaled a September cut is coming.

As Fed Chair Powell gears up for his annual address at the Jackson Hole conference this Friday, this note reviews the most releases this week: the Preliminary Benchmark Payrolls Revision as well as the release of the July FOMC meeting minutes.

Preliminary Benchmark Payrolls Revision: More Downbeat 2023, More Hopeful 2024

The March 2024 Preliminary CES Benchmark revision is an annual exercise that benchmarks the monthly employment from the BLS’s Establishment Survey over the year in March against data from state unemployment insurance tax records. It serves a preliminary estimate of the comprehensive benchmark revision of the Establishment Survey in February of the following year. So, the final benchmark revision in February 2025 can and will change relative to today’s preliminary numbers. Also, revisions will not officially be applied to the data until February 2025.

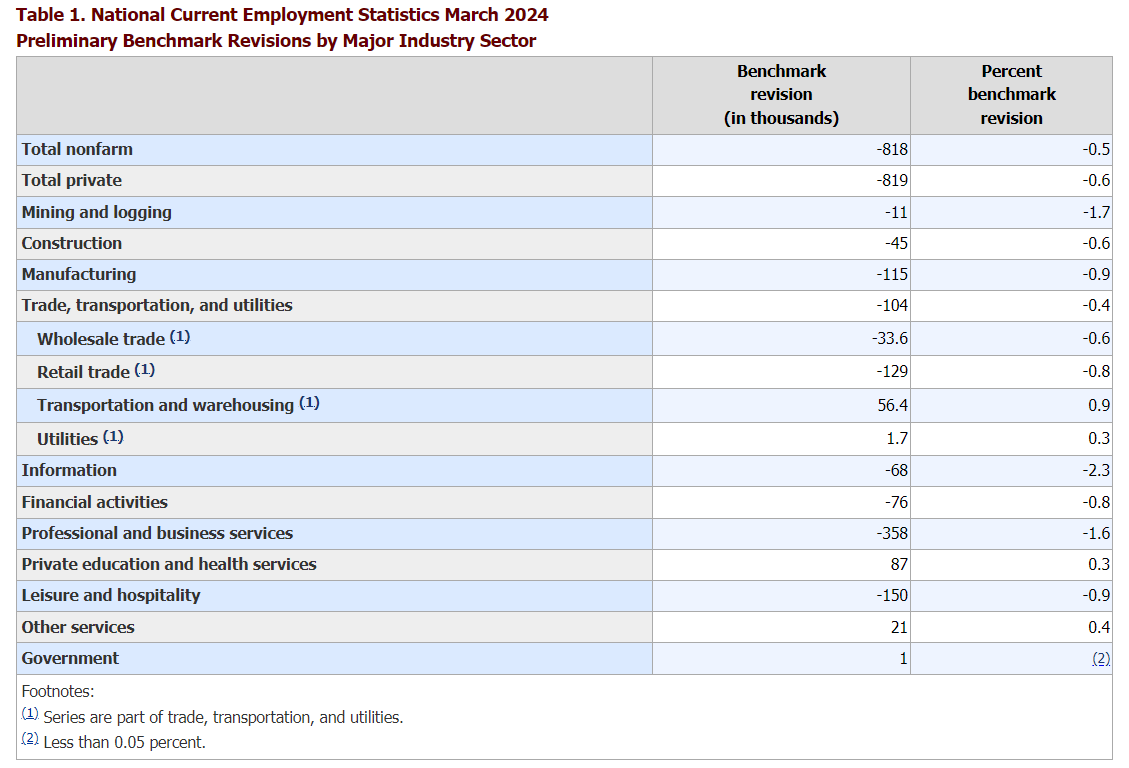

For the 12 months between April 2023 and March 2024, the BLS estimated in this preliminary benchmark that cumulative payrolls growth had been 818,000 persons less than initially thought (table above). Most of the implied downgrade took place in what economist would consider to be cyclical or interest rate sensitive sectors: leisure & hospitality, manufacturing, professional & business services and retail trade.

So, what could this potentially mean for recent payrolls growth trends? To get a feel of this one can apply the monthly average mismatch in job growth of about -68,000 persons (-818,000 persons divided by 12 months) and apply it to the official Establishment Survey payrolls number for April 2023 through March 2024 inclusive. The chart above suggests that these implied revisions for payrolls growth meant that relative to the official numbers, smoothed job growth trends slowed notably in H2 2023, from a 275,000-300,000 range in March 2023 to around 145,000 in December 2023. Since then, however, trends in implied revised payrolls show a recovery and stabilization in 2024 at around 170,000 instead of a slowing trend since December in the official data.

Note that the above exercise is an implied one, as the final revisions will not be completed and applied to the official payrolls until February 2025. Nonetheless, the implied trends in payrolls growth for 2024 based on today’s preliminary benchmark estimate suggest one can be quite hopeful that we have recently seen a labor market cooling rather than a labor market deterioration.

July FOMC Meeting Minutes: No News

Relative to the July FOMC post-meeting statement and press conference, today’s release of the minutes of the July FOMC meeting did not contain any news. It broadly confirmed a shift from an almost singular focus on inflation towards a focus on both inflation and employment:

Upside risks to the inflation outlook were seen as having diminished, while downside risks to employment were seen as having increased. Participants saw risks to achieving the inflation and employment objectives as continuing to move into better balance, with a couple noting that they viewed these risks as more or less balanced. Some participants noted that as conditions in the labor market have eased, the risk had increased that continued easing could transition to a more serious deterioration.

The minutes made clear that most FOMC members were happy with progress on inflation and that, if upheld in next week’s July Personal Income & Outlays report, last week’s CPI and PPI data have sealed the deal on a September rate cut:

Nevertheless, participants viewed the incoming data as enhancing their confidence that inflation was moving toward the Committee's objective. The vast majority observed that, if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting.

The minutes again confirmed a wide-varied view on how restrictive the Fed’s policy stance currently is, with some members already wanting the cut policy rates at this meeting. In aggregate this likely means more cautious pace of policy easing going forward as long as the labor market is not deteriorating sharply:

Many participants noted that reducing policy restraint too late or too little could risk unduly weakening economic activity or employment. A couple participants highlighted in particular the costs and challenges of addressing such a weakening once it is fully under way. Several participants remarked that reducing policy restraint too soon or too much could risk a resurgence in aggregate demand and a reversal of the progress on inflation.

The overall conclusion should be that the minutes and recent inflation data confirmed that the September FOMC meeting will be start of a rate easing cycle. However, given the tension between still elevated longer term trends in inflation, solid real activity data and cooling labor market trends, for the Fed the main focus of the rate easing cycle will be on dialing back restrictiveness rather than a quick return to neutral.

A view I, jointly with other ex-Fed staffers, also laid out in a recent interview. Indeed, if anything, last week’s data on jobless claims and retail sales as well as the earlier discussed preliminary payrolls benchmark revisions have made the case for large amounts of policy easing less urgent. Chair Powell’s address at this year’s Jackson Hole conference will therefore make the case for gradually reducing restrictiveness, as he did after the July FOMC meeting.