What Excess Savings?

The post-pandemic stock of excess savings hasn't run out yet. But consumption spending is now increasingly more backed by higher income growth.

During the COVID pandemic large-scale fiscal support packages for households combined with substantially suppressed consumption spending owing to social distancing measures resulted in large stocks of unspent household income in the U.S., a.k.a. excess savings. Many economists and analysts at policy and financial institutions have attempted to quantify the current levels of the stock of excess savings, as this could give us a gauge of how much more households could increase their consumption in the near term. This note revisits this issue.

The Current State of Play

Savings are typically calculated as the residual that’s left when household spending is subtracted from household disposable income. To determine the extent of excess savings, trends in savings need to be determined. In the context of the post-COVID cumulative excess savings discussion, a Federal Reserve Board analysis by Aladangady, Cho, Feiveson and Pinto (FEDS Notes, 2022) has become a standard reference. They fit a linear trend on the logarithm of the level of (components of) income and (components of) spending over the 2015-2019 period to get to such a trend savings measure and extrapolate for 2020 and beyond.

The choice of 2015-2019 as a reference point for trend savings, however, has often been criticized as arbitrary. Other analysts, including at investment banks, have chosen to use a shorter period as a reference point for trend estimates, such as 2017-2019 when the savings rate was relatively higher than for 2015-2019. Indeed, the difference in the resulting cumulative excess savings estimates between these two reference sample choices are quite substantial as can be seen in the chart below.

Besides the issue of choosing a suitable pre-COVID reference for trend savings estimates, one can also be critical of the assumption that U.S. households are expected to revert back to the savings behavior that is reflected by the chosen pre-COVID reference period. Using a time-varying trend estimate approach seems therefore more appropriate, as it potentially avoids “baking in” such a convergence when calculating the stock of excess savings.

Recent Federal Reserve Board analysis by de Soyres, Moore and Ortiz (FEDS Notes, 2023) does just that by employing the Hamilton (Rev Econ Statistics, 2018) filter. Adding the result of this approach to the chart above gives an entirely different set of accumulated savings estimates. Of course, there are a variety of different ways to get to time-varying trends besides the method from Hamilton (Rev Econ Statistics, 2018). They all have their pros and cons and provide often vastly different results. So, what to do?

An Alternative Approach

A common practice amongst economists to derive trends from data is to employ agnostic statistical tools that essentially smooth the data series of interest in a variety of ways. A very well-known approach is the Hodrick-Prescott filter, often criticized for smoothing series too much or too little depending on the preferences of the criticizer in question. For example, Hamilton (Rev Econ Statistics, 2018) and Phillips and Shi (IER, 2012) provide different perspectives on this Hodrick-Prescott filter and provide different solutions. And there are, of course, a lot more alternatives available in the literature.

Instead of taking a stance on an ‘ideal’ trend estimation method, I use a range of popular methods from the literature, which are discussed in the Box “Overview of Trend Estimation Methods” at the end of this post, to get a set of trend estimates. In a final step I then calculate an average from this set. Taking averages across different estimates is often applied in the forecasting literature, where such an average allows for different methods to be more relevant for the data at different points in time than in other periods while averaging out any big, outsized moves. It also is a very simple way to get to a trend estimate that reflects the uncertainty about which technique is the most appropriate for the data at hand.

So more specifically, for each of the components of savings (disposable personal income, consumption spending and other spending) I apply the 7 methods discussed in the Box below and calculate the average across the set of trend estimates for each of the savings’ components. Trend savings then equals the average of trend estimates for disposable income minus the average of trends for consumption spending minus the average of trends for other spending. The implied savings rate is plotted in the chart below. While my ‘average of trends’ trend savings rate measure was more or less in line with those commonly used by analysts during 2020 and most of 2021, it since then has shifted downward, suggesting a substantially lower trend savings rate by June 2023.

The chart above does suggest that not accounting for changes in the desired savings rate could potentially lead one to underestimate the current stock of accumulated savings, as a higher trend mechanically results in larger dissaving towards the end of the sample. Comparing the trend estimates with the actual savings rate it also seems that U.S. households will likely feel less of a need to eventually slow down consumption to get back to their desired rate based on the ‘average of trends’ trend estimate; the actual-trend savings rate gap is substantially smaller based on the ‘average of trends’ approach.

Why would the desired savings rate of U.S. households have decreased relative to the immediate years preceding the COVID pandemic? Research has shown that both low inflation expectations and pessimism associated with the prospects for rising unemployment contributes to elevated rates of savings by households. With the unemployment rate at historical lows throughout 2022 and 2023, pessimism about the labor market is, for now, not a reason for households to pursue higher savings rates. In terms of household inflation expectations, while stable recently, longer term inflation expectations generally have been 1 to 1.5 standard deviations above the 2017-2019 average of these longer-term expectations since late 2021 - see the chart below.

This suggests that households likely have shifted up their longer-term level of inflation expectations relative to the pre-COVID year. So, with persistently low unemployment diminishing the need for extra precautionary savings, and higher expected long-term inflation increasing the urge to consume more now than in the future, the recent downdrift in the trend savings rate is not surprising (chart above).

So How Much Is Left?

Applying the ‘average of trends’ to the savings components and cumulating the resulting excess savings forward from March 2020 gives us an estimate of the stock savings accumulated since that period. The chart below suggests that these at their peak totaled a sum of around $2.26 trillion by mid-2021, broadly equally driven by above trend growth in incomes owing to fiscal stimuli as well as consumption that was significantly depressed at below trend levels.

The largest drawdowns in the accumulated excess savings occurred in 2022 (chart above). The stock of excess savings allowed households to recover their consumption spending even in the face of sharply accelerating inflation and a Federal Reserve that pivoted from super accommodative towards aggressive rate hikes. Going into 2023 this dynamic has changed, as consumption spending continues to accelerate to above trend levels but now with disposable income also powering up beyond its trend. The end result is a slowdown in drawdowns from the pool of accumulated excess savings, which stood at about $614 billion in June.

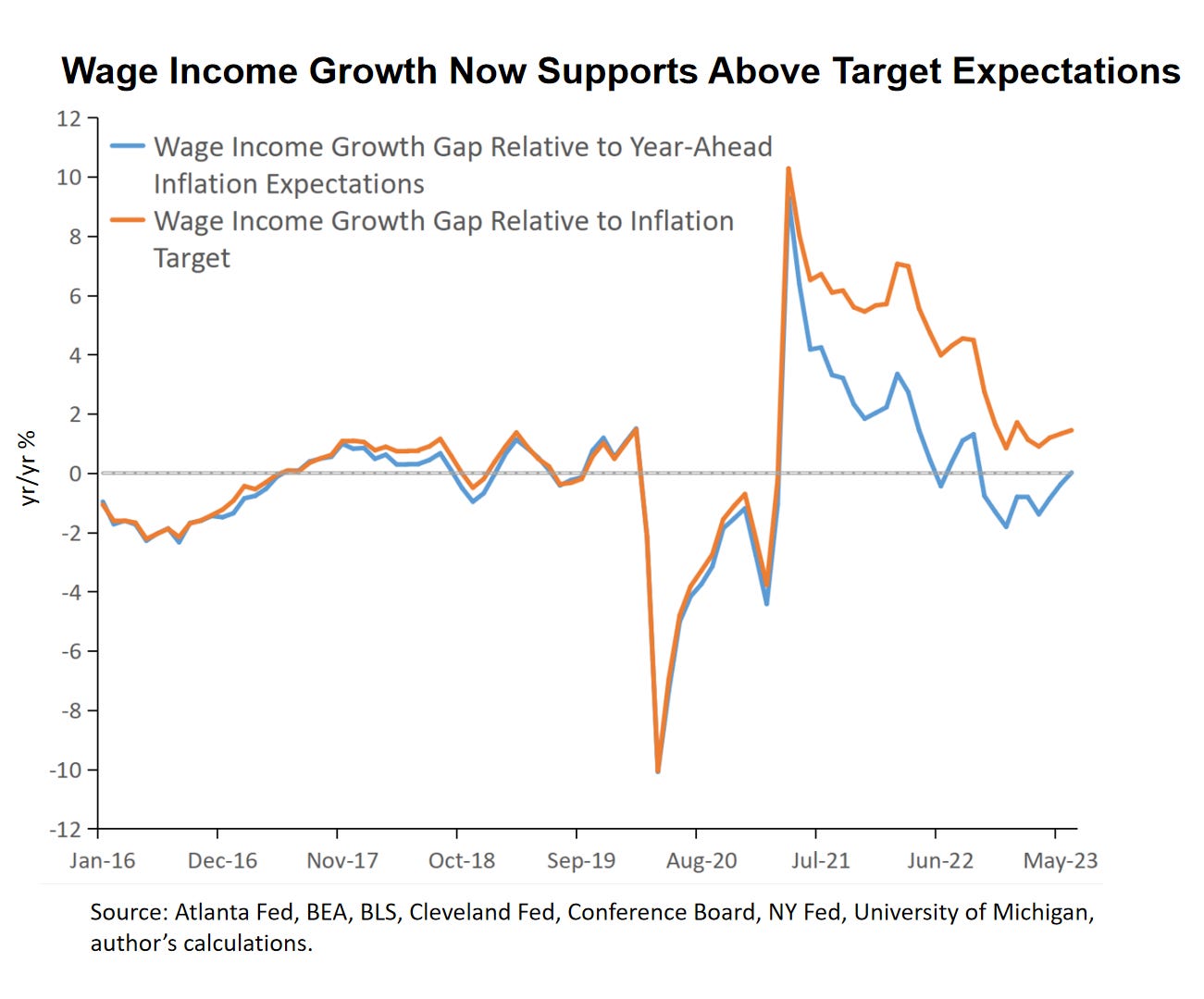

Accumulated excess savings as a driver behind consumption strength clearly was a 2022 theme but not so much for 2023. As I argued in an earlier note, household income out of wages and salaries is now growing at a pace that can sustain PCE inflation in the 3%-3.5% range (chart above). And the resulting declining need to drawdown the stock of excess savings means some of this stock will likely still be available to households when we move into 2024. The combination of these two means solid consumption spending as a main driving force that keeps aggregate demand elevated relative to supply for the near future. The Fed will take note of that.

Box: Overview of Trend Estimation Methods

I use 7 purely statistical approaches to proxy trends in disposable income, consumption spending and other spending: (i) A cubic trend time trend; (ii) Successively applying the Hodrick-Prescott filter until unit root tests are satisfied, as suggest by Phillips and Shi (IER, 2021); (iii) The same as in (ii) but until a BIC criterion is satisfied; (iv) Applying the Quast and Wolters (JBES, 2022) version of the Hamilton (Rev Econ Statistics, 2018) filter (where the trend results from regressing the current level on many lags); (v) Transforming into monthly changes and then locally averaging these changes using sliding windows of 99 monthly observations (weighted by means of a bi-weight kernel) as in Stock and Watson (BPEA, 2012); (vi) Same as in (v) but now using sliding windows of 75 monthly observations; (vii) the Christiano and Fitzgerald (IER, 2003) bandpass filter with a bandpass between 6 and 96 months There is a large variation across the respective estimates, so I use the average of the 7 estimates to proxy trends in disposable income, consumption spending and other spending, respectively, with the differential between trend disposable income and trend spending components giving me trend savings. As such the resulting savings trend reflects the uncertainty with respect to 'true' trend level of savings.