March Personal Income & Outlays: A Good Month

Near-term trends in underlying inflation eased but remained elevated above 2%. Consumption growth picked up, but wage income growth remained tepid.

The March Personal Income and Outlays report provides a good insight into the U.S. consumer as well as inflationary pressures going forward. This note presents some of these insights.

Key takeaways:

The central tendency measures of PCE inflation eased somewhat but remain to close to 3% on a six-month basis. On a three-month basis these metrics slowed even more even more, and over an annual horizon the different underlying inflation rates still suggest a longer-term pace for core PCE inflation that’s above 2.5%.

Personal income growth out of wages and salaries slowed again in March. This meant that household wage income continued to grow somewhat below the pace that’s consistent with 2% PCE inflation over the medium-term.

The stock of excess savings has NOT run out and continues to be a tailwind for consumption. Between February and March, it fell only around $14 billion and equaled about $403 billion in March.

Headline consumption growth on a three-month basis increased just above its underlying spending growth pace in March. Real spending on durable goods jumped owing to ongoing tariff hike fears and services consumption recovered over the month. The annual trend in real spending remains solid, so one should not expect another dramatic downshift in consumption beyond the current quarter.

With consumption spending remaining on a solid growth trajectory and trends in underlying inflation still point to an above-target medium-term core inflation pace the Fed will likely abstain from further rates cuts for quite a while. While slower wage income growth could help counteract elevated inflation at some point, the Fed especially wants to gauge how much supply-side disruptions owing to trade policy could derail the inflation process through elevated inflation expectations.

Medium Term Underlying Inflation Eased

Core PCE inflation decelerated sharply in March to about a 0.3% annualized monthly rate from 6.1% in February (upwardly revised from 4.5%). Core goods inflation turned negative in March at -3.1% annualized month/month, after recording a +5% in February (essentially unrevised). Core service inflation also slowed notably, to 1.5% annualized month/month in March from an upwardly revised 6.5% in the preceding month.

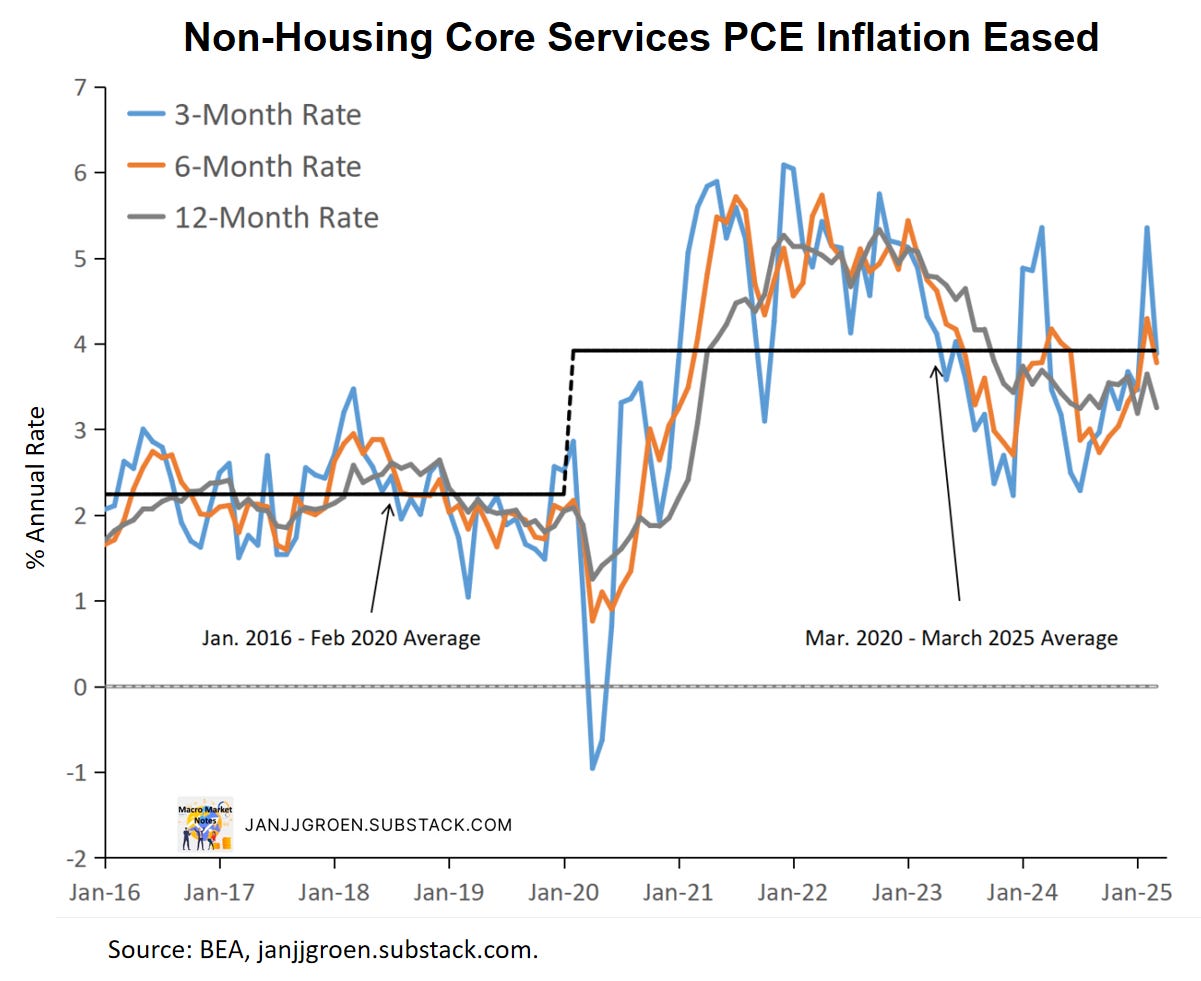

Weakness in the Fed’s favorite gauge of underlying inflation, core services excl. housing PCE inflation, was the driver behind slowing overall core services inflation, as it dropped from (an upwardly revised) 7.4% annualized month/month in February to about 0.5%. Given the large volatility in this measure since the pandemic it is better to smooth through noisy month-over-month dynamics.

The chart above plots three-, six- and 12-month annualized inflation rates for the non-housing core services PCE deflator. The average annualized monthly rate reads about 3.9% for the post-COVID era (black dashed line), almost two times the average rate we observed for the immediate years pre-COVID.

Momentum in this non-housing core services inflation measure eased a lot with the three-month annualized inflation rate decelerating from 5.4% to around 3.9% in March. Furthermore, the six-month rate also declined somewhat. Note that since early 2024 the twelve-month rate has been range bound around 3.5%. Would the post-COVID long-run trend settle around this 3.5%, and with non-housing core services contributing about 55%-60% to core PCE inflation, this would still push up core inflation structurally higher by at least 80 basis points vs. 2016-2019.

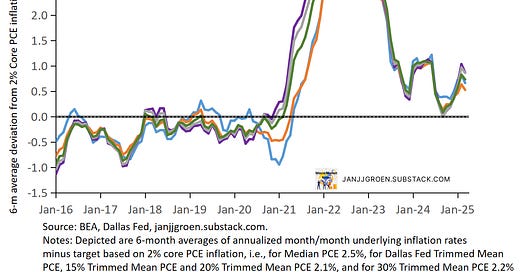

Instead of focusing on whether specific components of inflation should be ignored or not when assessing underlying inflation trends, one could focus on the central tendency of consumer price inflation, a.k.a. the center of the distribution of all price changes unaffected by extremely volatile consumer price components. This could potentially provide a better sense of the target toward which inflation moves over time once those excessively volatile price changes have stabilized.

Such measures of central tendency for the PCE price indices use a variety of trimming procedures to weed out excessive volatile components of these price indices in a given month:

Median PCE, which takes the inflation rate of the component at the 50% percentile of the PCE component price changes.

Trimmed Mean PCE (Dallas Fed), where the highest 31% and lowest 24% of PCE component price changes are dropped.

15% Trimmed Mean PCE, where the highest 7.5% and lowest 7.5% of PCE component price changes are dropped.

20% Trimmed Mean PCE, where the highest 10% and lowest 10% of PCE component price changes are dropped.

30% Trimmed Mean PCE, where the highest 15% and lowest 15% of PCE component price changes are dropped.

To get a sense of near-term trends in underlying PCE inflation I look at six-month averages of the annualized percentage point deviation of the above monthly central tendency inflation measures relative to their values as implied by 2% core PCE inflation. This is also consistent with public statements by Fed officials that they’d like to see sustained progress of inflation converging back to target, as measured over months and quarters of inflation progress.

For most trimmed mean PCE inflation rates the six-month average deviations relative to the inflation target troughed by the end of the summer of ‘24 (chart above). Since then, these six-month measures have steadily been on the rise, and by February these measures are implying a six-month pace around 3% core PCE inflation. In March these eased somewhat but still remained well above the Fed’s 2% inflation target.

The chart above looks at three-month average deviations from 2% core PCE inflation across the underlying PCE inflation measures and, similar to the six-month averages, have generally been rising since September. Today’s report suggests that these three-month averages stepped down in March but that these also imply a notable spread in terms of implied core PCE inflation paces: from close to 3.1% to 2.3% (Dallas Fed Trimmed Mean). So, on the eve of “Liberation Day” there was a lot of uncertainty about how much easing in near-term underlying inflation trends there actually was in the pipeline before the tariffs hike impact.

On an annual basis, 12-month average deviations of underlying PCE inflation rates relative to the inflation target in the chart above also eased but generally continue to suggest a longer-term pace above 2.5% core PCE inflation.

Wage Income Growth Slowed Again

There were no significant revisions to the recent path of household income out of wages and salaries. The year/year wage income growth rate in March slowed for the third consecutive month to 2.9% from 3.2% in February (essentially unrevised).

To interpret wage income growth trends, I earlier proposed to compare wage income growth with a neutral benchmark growth rate based on trend non-farm business sector (NFB) output growth and either the abovementioned common inflation expectations factor or the 2% Fed inflation target. Similar to what I did when discussing wages and inflation expectations in my October 2023 update, I now also incorporate trend labor share growth into this neutral benchmark.

Any deviation in actual household wage income growth above or below the aforementioned inflation target-consistent neutral benchmark means household wage income growth outpaces or cannot sustain in the medium term the 2% inflation target.

The chart above shows that the wage income growth gap vs the 2% inflation target pace shrank for the third consecutive month. Using today’s data vintage, the slowing of March household income growth out of private sector wages meant that current wage income growth is below the pace consistent with 2% PCE inflation over the medium term.

Smoothing the nominal wage income growth gap over three months today’s report suggests that household spending growth appears to be still more or less consistent with a sustainable return of inflation to 2%.

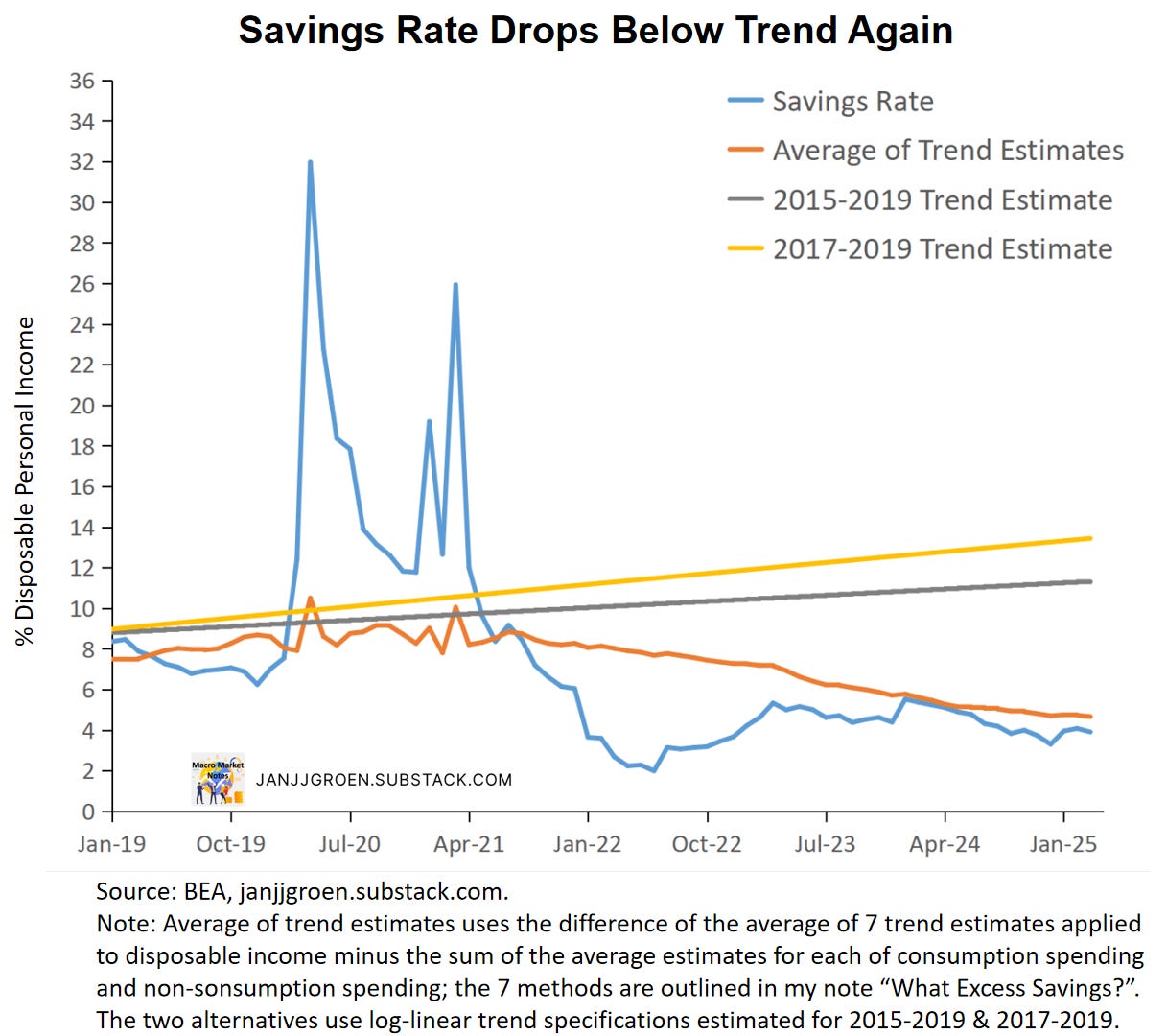

Nominal consumer spending increased 0.7% over the month in March, with disposable household income growing 0.5% for the same period. As a consequence, the savings rate decreased to 3.9% in March compared to 4.1% previously (downwardly revised from 4.6%).

Over the month the savings rate dropped further below my trend savings rate estimate of about 4.7% in March using the ‘average of trend’ approach outlined in my earlier excess savings note (orange line in the chart above). This trend savings rate estimate has been essentially unchanged since December.

Using these estimated trend savings rates, the chart above shows that above-trend growth in disposable income continues to be a partial offset to the drawdowns in excess savings coming from above-trend growth in both consumption spending and interest payments (green bars vs orange + blue bars). But downside revisions to my trend savings rate estimates for January and February, March cumulative excess savings declined from $417 billion in the previous month (revised down from $354 billion) to about $403 billion (see chart above). A lot of households (especially middle- and higher-income ones) continue to have access to a sizeable buffer to deal with shocks and higher-than-expected price increases.

Real Consumption Growth Went Up

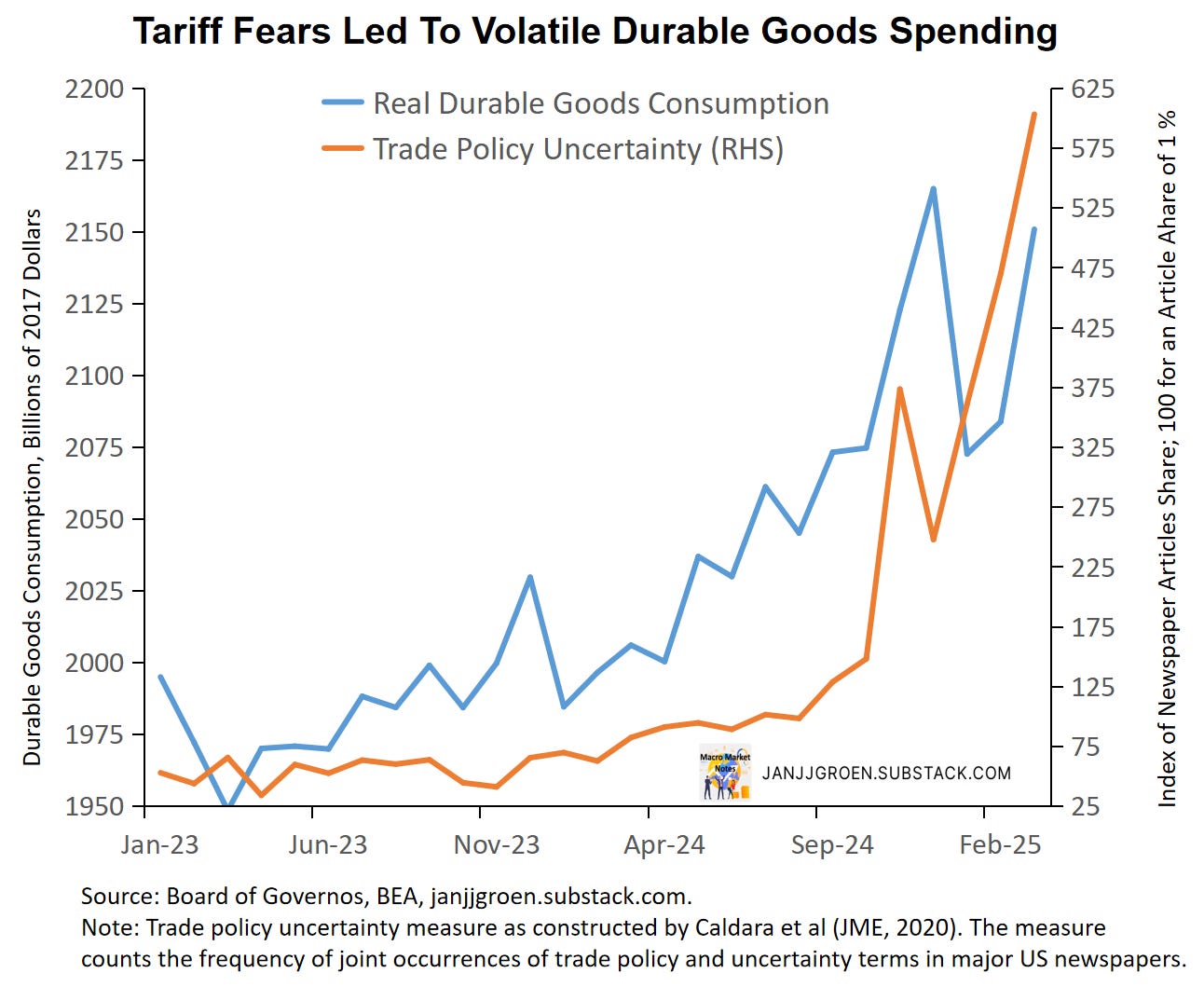

Over the month inflation-adjusted consumption expenditures rose 0.7%, a notable acceleration compared to a +0.1% growth rate in February and -0.4% in January. Both real durable goods consumption and services consumption were the drivers behind this real consumption growth acceleration, as real durable goods consumption grew 3.2% month/month after increasing 0.5% in February whereas real services consumption went from essentially flat in February to +0.4% in March. The latter was foreshadowed by the large inflation-adjusted bar/restaurant spending bounce back in the March retail sales report.

In particular the large swings in durable goods consumption during Q1 stands out. As the chart above suggests, fluctuations in trade policy uncertainty have since the fall lead variations in real durable goods spending by about a month. Especially during Q1 this uncertainty exploded as it became clear major tariff hikes were forthcoming, which drove households to pull forward durable goods purchases, as these were most likely to be hit by these hikes. The chart indicates that some of this “pull forward” spending behavior might well spill over into April before settling down closer to historical trends.

As is the case with headline inflation, headline real consumption spending growth often is driven by volatile components that not always reflect the underlying strength of the economy. An underlying real consumption spending growth measure, therefore, would be really useful, and I do that by approximating such a core measure based on the weighted median across 177 components1 of headline real personal consumption expenditures (PCE). More specifically, the underlying consumption growth measure equals the growth rate of the real PCE component at the 50% percentile across growth rates of these 177 sub-components of headline real PCE.

The chart above focuses on three-month annualized consumption growth rates. Real consumption spending firmed up from 1.1% in February (upwardly revised from 0.2% previously) to 1.7% in March. While February three-month consumption spending growth dropped below the corresponding median rate, in March it picked up to just above the underlying pace of 1.4%.

The above chart suggests that the initial upward skew in real spending (with headline three-month growth far outpacing median growth) at start of Q1, likely owing to tariff fears, has now largely ran its course. And with services consumption picking back up this suggest that we’ll have more stable consumption expenditures going forward.

As the chart above shows, on an annual basis headline real consumption growth still runs above the median growth rate, with the latter implying 2% growth year/year. So as long as wage income growth remains solid, absent an implosion of the labor market, consumption growth should not slow too much with real spending remaining solid and close to trend in upcoming quarters.

On the eve of “Liberation Day” consumption spending recovered to a healthy pace by the end of Q1 (but growing at a pace closer to trend than in Q3 and Q4). While underlying inflation rates eased in March, the trends in these rates still point to above-target inflation dynamics, and supply-side disruptions owing to trade policy could derail the inflation process through elevated inflation expectations. The Fed therefore will remain cautious and likely not ease rates for a while in 2025.

For a description of these 177 components, see Appendix A in the Dallas Fed trimmed mean PCE inflation working paper, where I use the corresponding real quantities instead of the price indices.