July FOMC Postmortem & June PCE

Underlying inflation trends firmed, remaining above 2%. Consumption growth was slowed but solid and wage income growth was stronger. The Fed will not cut soon.

The June Personal Income and Outlays report provides a good insight into the U.S. consumer as well as inflationary pressures going forward. This note presents some of these insights and also provides a brief postmortem of the July FOMC meeting.

Key takeaways:

As expected, the Fed kept its Fed funds target range unchanged at 4.25%-4.5%. Also as expected, Governors Waller and Bowman dissented in favor of a 25bps rate cut.

Most notable coming out of the July FOMC meeting were Chair Powell’s post-meeting remarks, indicating that the majority of FOMC views the inflation mandate more ‘out-of-whack’ than the employment mandate. Underlying inflation trends beyond tariff impacts were acknowledged to have been overshooting the Fed’s target.

The central tendency measures of PCE inflation firmed up over the month and remain elevated in a 2.7%-3% core PCE inflation range on a six-month basis.

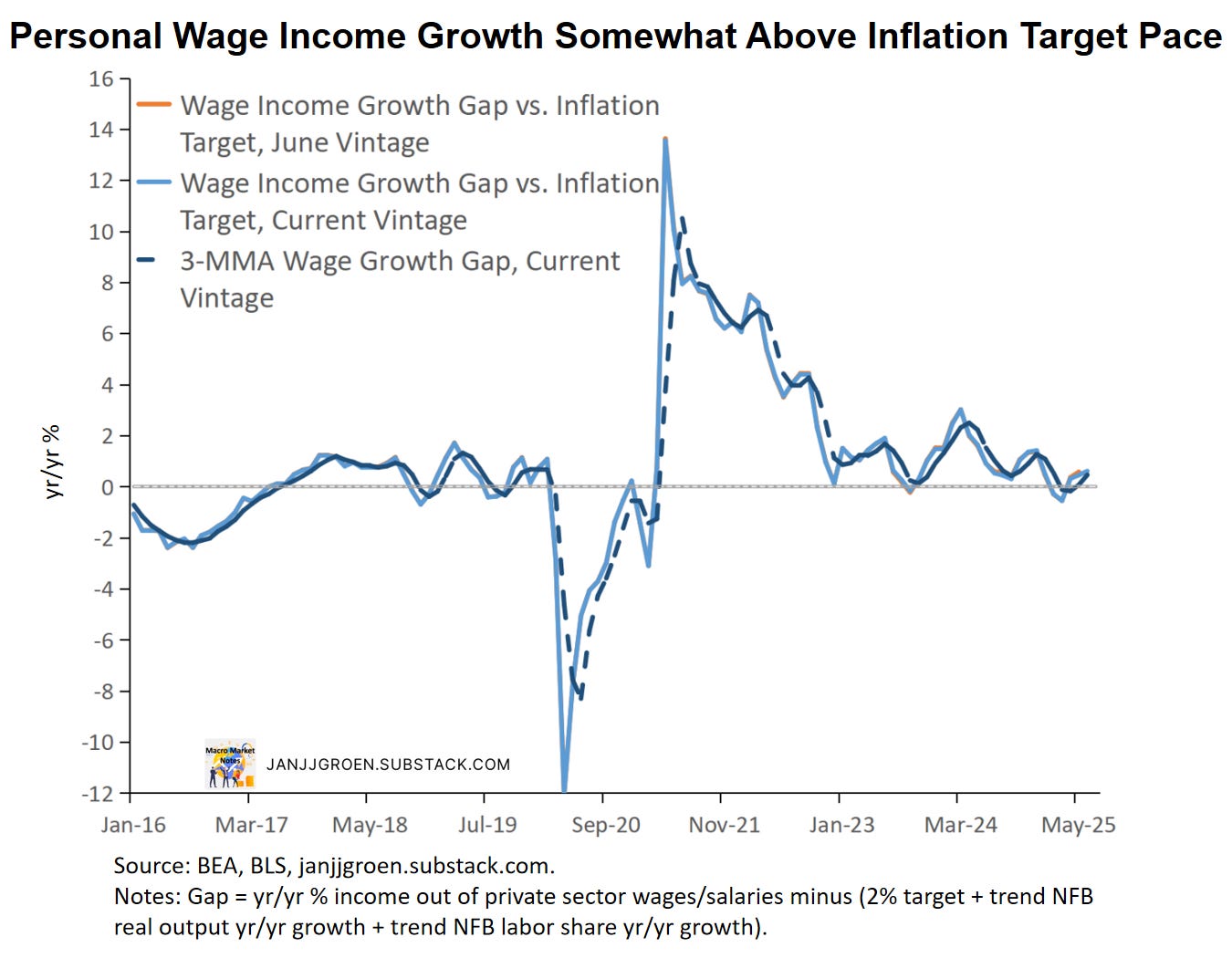

Personal income growth out of wages and salaries went up and it is growing somewhat above the pace that’s consistent with 2% PCE inflation over the medium-term.

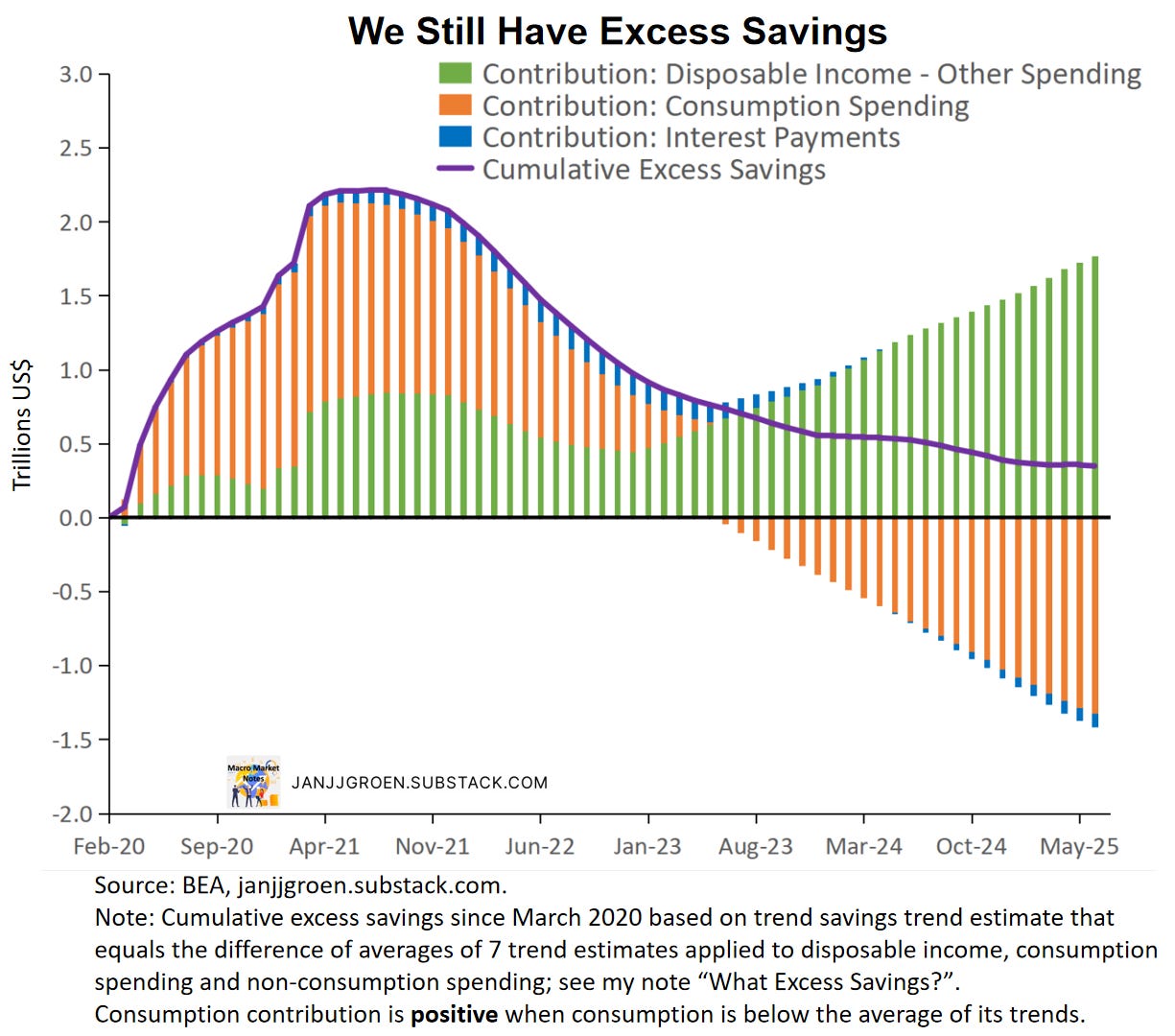

The stock of excess savings has NOT run out and continues to be a tailwind for consumption. Between May and June, it decreased by around $6 billion and equaled about $348 billion in June.

Real consumption spending growth recovered over the month, largely due to rebound in goods spending growth. The annual trend in real spending slowed and is no more in line with the underlying trend pace.

Consumption spending was solid but not overly strong as households try to preserve their precautionary savings, but higher wage income growth means this will not counteract elevated inflation and trends in underlying inflation still point to an above-target medium-term core inflation pace. Given this the Fed will likely abstain from further rates cuts this year, as it gauges how much supply-side disruptions owing to trade policy could derail the inflation process through elevated inflation expectations.

July FOMC Postmortem

As expected, the FOMC decided for the fifth consecutive month to keep the Fed funds rate target range unchanged at 4.25%-4.50%. The post-meeting statement showed fairly minor changes that reflected the slowdown in GDP in H1 2025 and emphasized more strongly elevated uncertainty:

Although swings in net exports

have affectedcontinue to affect the data, recent indicators suggest that economic activityhas continued to expand at a solid pacemoderated in the first half of the year. The unemployment rate remains low, and labor market conditions remain solid. Inflation remains somewhat elevated.The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic outlook

has diminished but remains elevatedremains elevated. The Committee is attentive to the risks to both sides of its dual mandate.In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4‑1/4 to 4‑1/2 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr;

Michelle W. Bowman;Susan M. Collins; Lisa D. Cook; Austan D. Goolsbee; Philip N. Jefferson;Adriana D. Kugler;Alberto G. Musalem; Jeffrey R. Schmid;and Christopher J. Waller.

Voting against this action were Michelle W. Bowman and Christopher J. Waller, who preferred to lower the target range for the federal funds rate by 1/4 percentage point at this meeting. Absent and not voting was Adriana D. Kugler.FOMC Statement, June 18, 2025 (with annotations relative to the May FOMC statement).

As expected, Governor Waller dissented in favor of a 25bps rate cut and was joined in his dissent by fellow Governor Bowman. The fact that both Trump-appointed members of the Board of Governors dissented and favored rate cuts after the administration’s efforts to pressure to Fed into a rate cutting mode clearly reflects a political statement of the administration in the direction of the Fed. Given the data dynamics this sets us up for a very tense back-and-forth for the remainder of the year, as I continue to expect that these dynamics will drive an unwillingness amongst a majority of the FOMC to change policy rates.

Chair Powell’s remarks at the post-meeting press conference was really the most important aspect of this meeting. In the Q&A session he several times laid out the view of the majority that given inflation remaining above target and a labor market close to full employment it is prudent policy to keep the policy stance moderately restrictive. When challenged that tariffs are most likely a one-off price level change and that the Fed should look through these effects, he acknowledged that this indeed is a solid base case, but not a certain one, However, by staying on hold when facing higher inflation (instead of hiking presumably), the Fed is actually trying to look through the (hopefully) transitory tariff impacts. A very sensible response, in my view.

More explicitly than in the past, Chair Powell acknowledged that the underlying inflation trend runs above target as “… even looking beyond tariffs, inflation still remains moderately above target” (Powell, July 2025 FOMC meeting press conference). This is in contrast with Governor Waller who, erroneously in my opinion, views underlying inflation to be well aligned with the Fed’s inflation target. Indeed, the June PCE report that was published the day after the July meeting validated Chair Powell’s view on this issue. So, lets dig into that data release.

Medium Term Underlying Inflation Stubbornly Elevated

Core PCE inflation accelerated in June at 3.1% annualized monthly rate vs about 2.6% (upwardly revised) in May. Core goods inflation jumped up in June to +4.8% annualized month/month after recording +3% in May (upwardly revised). Core service inflation also picked up the pace somewhat to 2.6% annualized month/month in June from an upwardly revised 2.4% in the preceding month. Within core services, core services excl. housing PCE inflation went up from (an upwardly revised) +2.2% annualized month/month in May to about +2.3%.

Instead of focusing on whether specific components of inflation should be ignored or not when assessing underlying inflation trends, one could focus on the central tendency of consumer price inflation, a.k.a. the center of the distribution of all price changes unaffected by extremely volatile consumer price components. This could potentially provide a better sense of the target toward which inflation moves over time once those excessively volatile price changes have stabilized.

Such measures of central tendency for the PCE price indices use a variety of trimming procedures to weed out excessive volatile components of these price indices in a given month:

Median PCE, which takes the inflation rate of the component at the 50% percentile of the PCE component price changes.

Trimmed Mean PCE (Dallas Fed), where the highest 31% and lowest 24% of PCE component price changes are dropped.

15% Trimmed Mean PCE, where the highest 7.5% and lowest 7.5% of PCE component price changes are dropped.

20% Trimmed Mean PCE, where the highest 10% and lowest 10% of PCE component price changes are dropped.

30% Trimmed Mean PCE, where the highest 15% and lowest 15% of PCE component price changes are dropped.

These trimmed mean inflation measures accelerated over the month in June. Scaled in month/month core PCE inflation, June figures ranged from 3.2% (median PCE) to 3.6% (10% trimmed mean PCE).

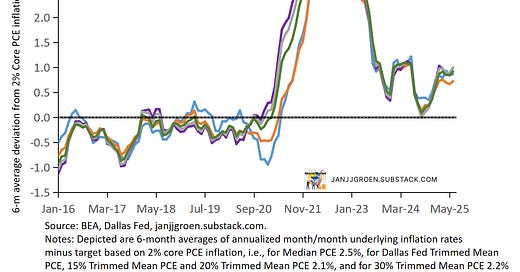

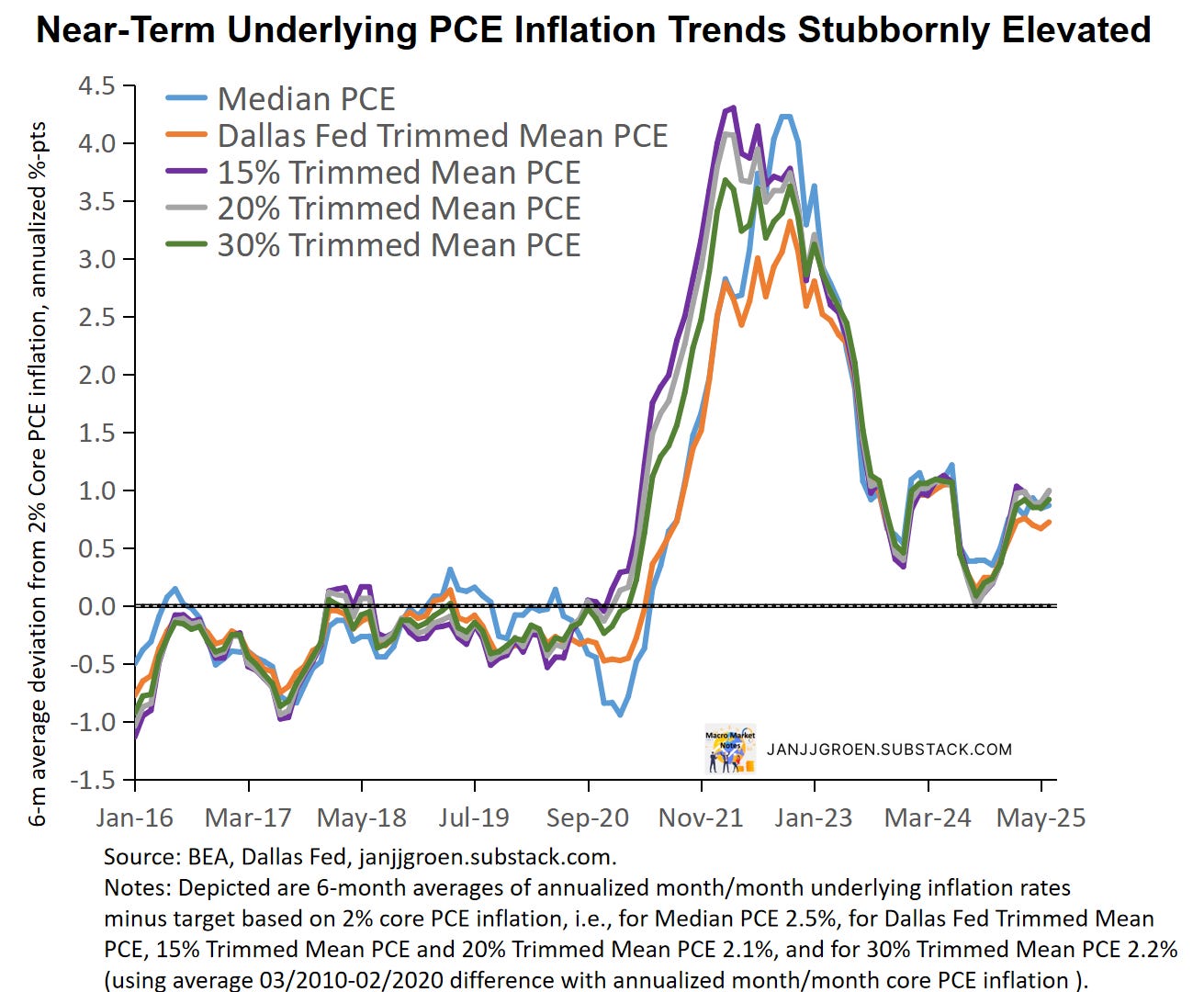

To get a sense of near-term trends in underlying PCE inflation I look at six-month averages of the annualized percentage point deviation of the above monthly central tendency inflation measures relative to their values as implied by 2% core PCE inflation. This is also consistent with public statements by Fed officials that they’d like to see sustained progress of inflation converging back to target, as measured over months and quarters of inflation progress.

For most trimmed mean PCE inflation rates the six-month average deviations relative to the inflation target troughed by the end of the summer of ‘24 (chart above). Since then, these six-month measures have steadily been on the rise, and by February these measures were implying a six-month pace of in the 2.8%-3% core PCE inflation range. In March and April these eased but reaccelerated again since then and are currently in a 2.7%-3% core PCE inflation range in June — well above the Fed’s 2% inflation target.

The chart above looks at three-month average deviations from 2% core PCE inflation across the underlying PCE inflation measures and, similar to the six-month averages, have generally been rising between September and February. And although these three-month averages stepped down in May today’s report suggests an across-the-board reacceleration in June, with a spread in April from about 2.9% (median PCE) to 2.6% (10% trimmed mean PCE). So, there does not appear to be much easing in near-term underlying inflation trends in the pipeline.

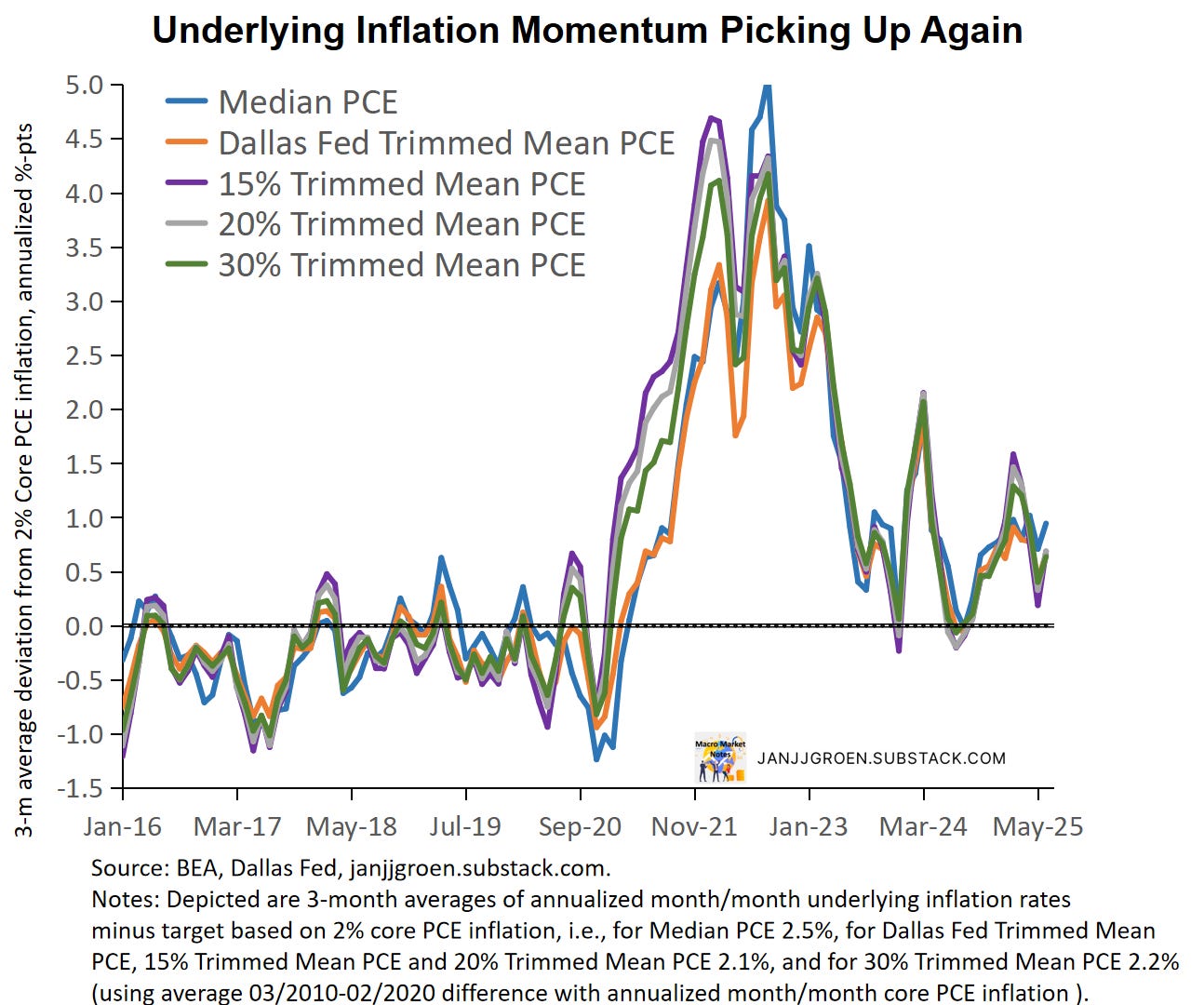

On an annual basis, 12-month average deviations of underlying PCE inflation rates relative to the inflation target have been stuck above 2% and recently picked up the pace in the chart above towards a 2.6%-2.7% range in core PCE inflation terms.

Wage Income Growth Robust

There were no significant revisions to the recent path of household income out of wages and salaries. The year/year wage income growth rate in April accelerated to 4.6% from 4.5% in May (revised down from 4.6% previously).

To interpret wage income growth trends, I earlier proposed to compare wage income growth with a neutral benchmark growth rate based on trend non-farm business sector (NFB) output growth and either the abovementioned common inflation expectations factor or the 2% Fed inflation target. Similar to what I did when discussing wages and inflation expectations in my October 2023 update, I now also incorporate trend labor share growth into this neutral benchmark.

Any deviation in actual household wage income growth above or below the aforementioned inflation target-consistent neutral benchmark means household wage income growth outpaces or cannot sustain in the medium term the 2% inflation target.

The chart above shows that based on today’s data vintage household income growth out of private sector wages (blue line) is creeping away from inflation target pace. Smoothing the nominal wage income growth gap over three months today’s report suggests that household wage income growth appears to be somewhat inconsistent with a sustainable return of inflation to 2%.

Nominal consumer spending increased 0.3% over the month in June, with disposable household income growing 0.3% for the same period. As a consequence, the savings rate remained broadly unchanged at 4.5% in June. The savings rate has been at or close to my trend savings rate estimate of about 4.8% in June using the ‘average of trend’ approach outlined in my earlier excess savings note. This trend savings rate estimate has been essentially unchanged since the start of the year.

Using these estimated trend savings rates, the chart above shows that above-trend growth in disposable income continues to be a partial offset to the drawdowns in excess savings coming from above-trend growth in both consumption spending and interest payments (green bars vs orange + blue bars). June cumulative excess savings declined from $354 billion in the previous month to about $348 billion (see chart above). Households (especially middle- and higher-income ones) continue to have access to a sizeable buffer to deal with shocks and higher-than-expected price increases with continued policy uncertainty providing an incentive to maintain this stock of precautionary savins.

Real Consumption Growth Slowed

Over the month inflation-adjusted consumption expenditures rose 0.1%, an acceleration compared to a -0.2% growth rate in May. Services consumption growth remained stable at 0.1%, whereas goods consumption growth picked up the pace notably from -0.8% in May to +0.1%.

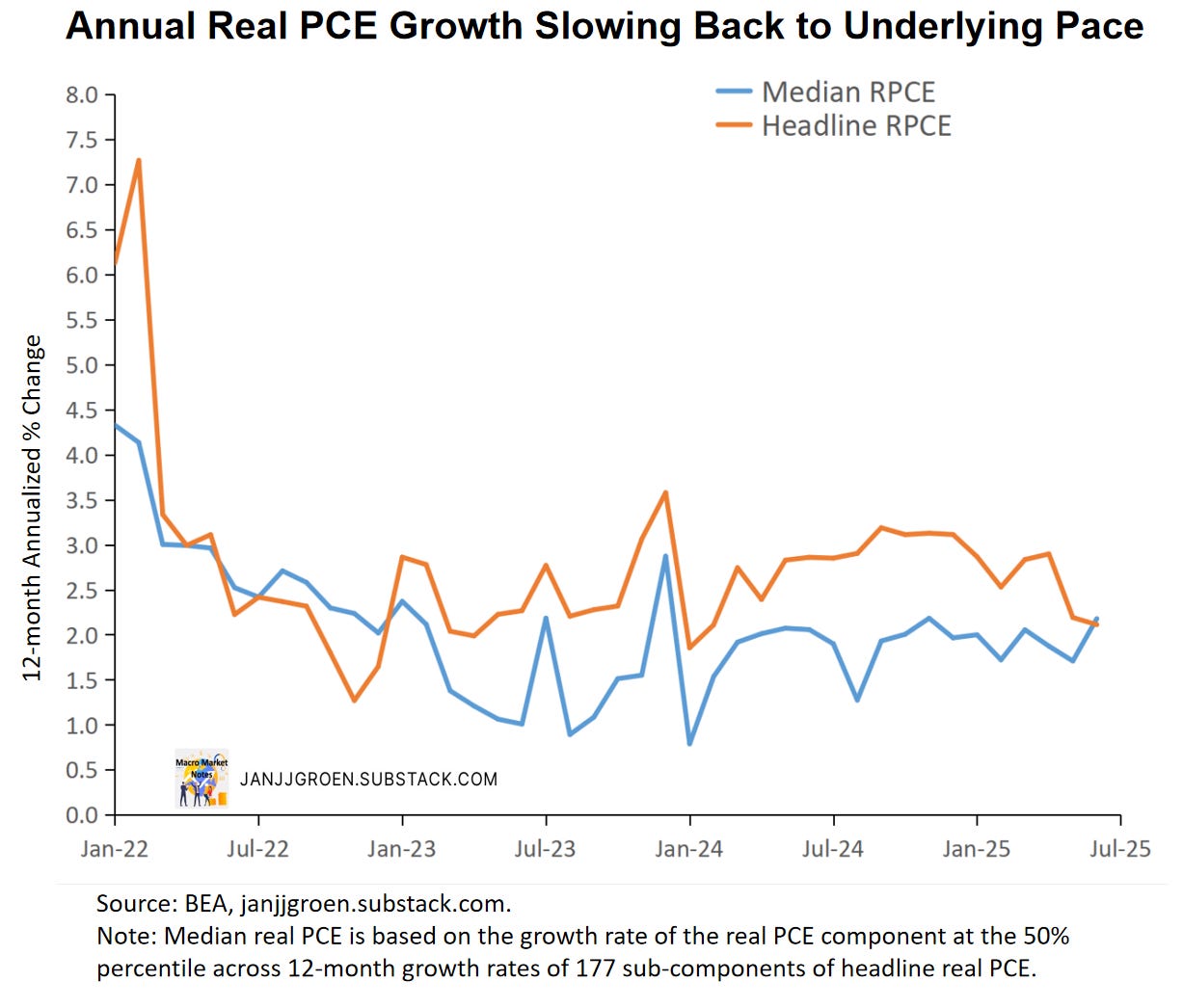

As is the case with headline inflation, headline real consumption spending growth often is driven by volatile components that not always reflect the underlying strength of the economy. An underlying real consumption spending growth measure, therefore, would be really useful, and I do that by approximating such a core measure based on the weighted median across 177 components1 of headline real personal consumption expenditures (PCE). More specifically, the underlying consumption growth measure equals the growth rate of the real PCE component at the 50% percentile across growth rates of these 177 sub-components of headline real PCE.

As the chart above shows, on an annual basis headline real consumption growth has since “Liberation Day” slowed to a pace in line with the median growth rate, with the latter implying 2.2% growth year/year. So, after a long period of strong consumption growth trends, these now seem to settle close to trend going forward. Consumption growth isn’t signaling a recession just yet.

Underlying inflation rates accelerated again in June, with the trends in these rates still pointing to above-target inflation dynamics. Real spending recovered to a solid but not overly strong pace. With household wage income growth remaining relatively strong, this suggest that consumption spending easing is not so much due to an inability to spend but rather an unwillingness as households seek to preserve precautionary savings to deal with a more uncertain environment.

For now, this data trends outlined in this note supports the notion amongst a majority on the FOMC to keep policy rates on hold at somewhat restrictive levels to prevent a greater overshoot of the underlying inflation trends relative to the Fed’s 2% target. The Fed therefore will remain cautious and likely not ease rates in 2025.

For a description of these 177 components, see Appendix A in the Dallas Fed trimmed mean PCE inflation working paper, where I use the corresponding real quantities instead of the price indices.