Sep Payrolls: Surging Into the Fall

September payrolls growth accelerated again, the unemployment rate eased, but the job-finding rate decreased somewhat. Wage growth remains elevated.

Today’s release of the September Employment Situation report confirmed that the labor market continued to recover from a difficult stretch over the summer. Payrolls growth accelerated again, with underlying trends edging up. The unemployment rate ticked down again but the job-finding probability eased somewhat. Wage growth remained elevated compared to trends. This data is in line with a moderate rate cutting pace that the Fed has outlined recently.

Key takeaways:

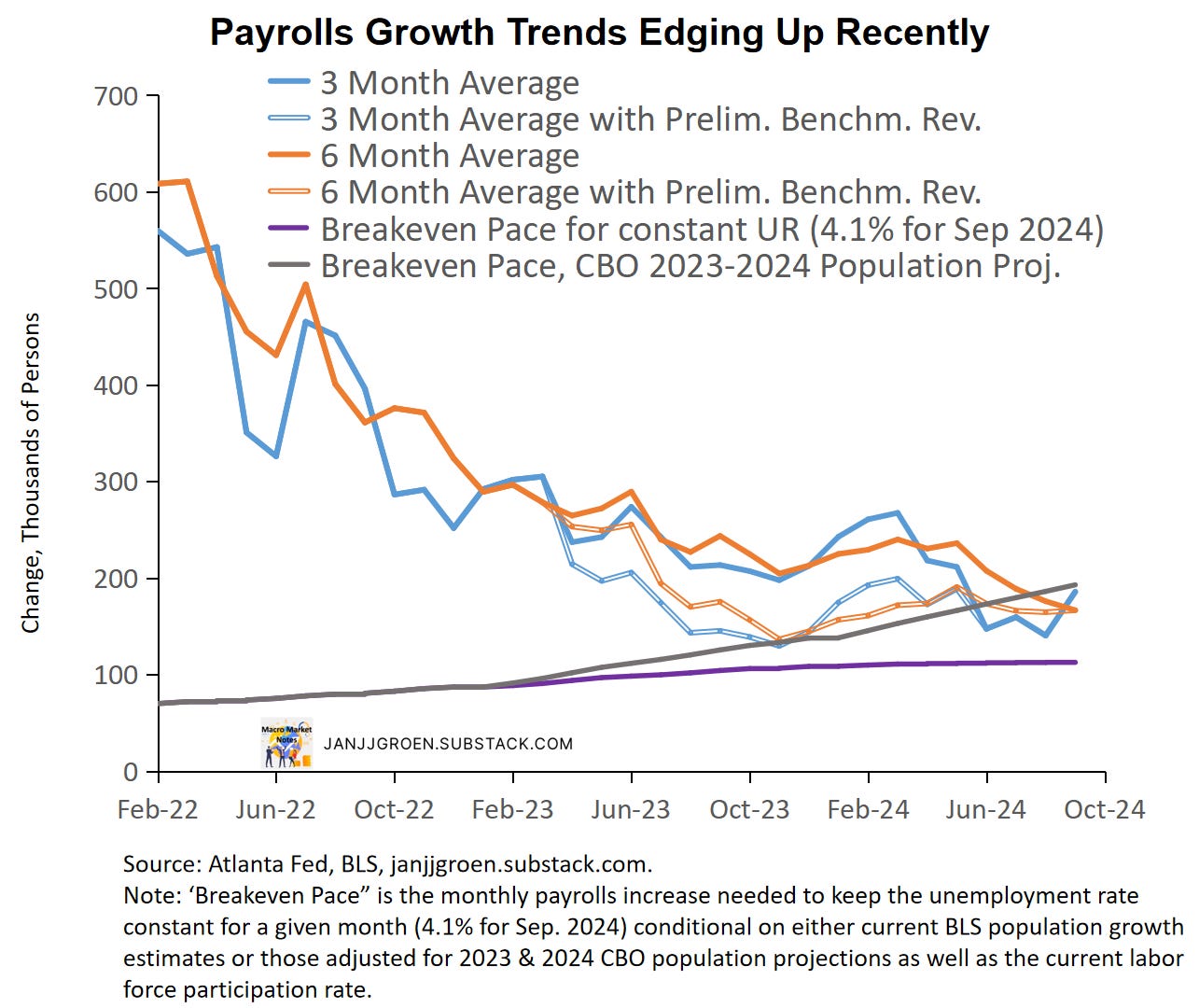

Payrolls growth picked up again in September, with trends now close to the breakeven pace needed to keep the unemployment rate constant at current levels given higher-than-expected population growth.

The unemployment rate eased to 4.1% as the labor force participation rate remained unchanged at 62.7%.

The job-finding rate decreased over the month at 49% with smoothed trends at around 48%. The unemployment rate consistent with recent job-separation and job-finding rates continues to decline. Smoothed trends suggest that in the near term the unemployment rate will likely stabilize around 4.2%.

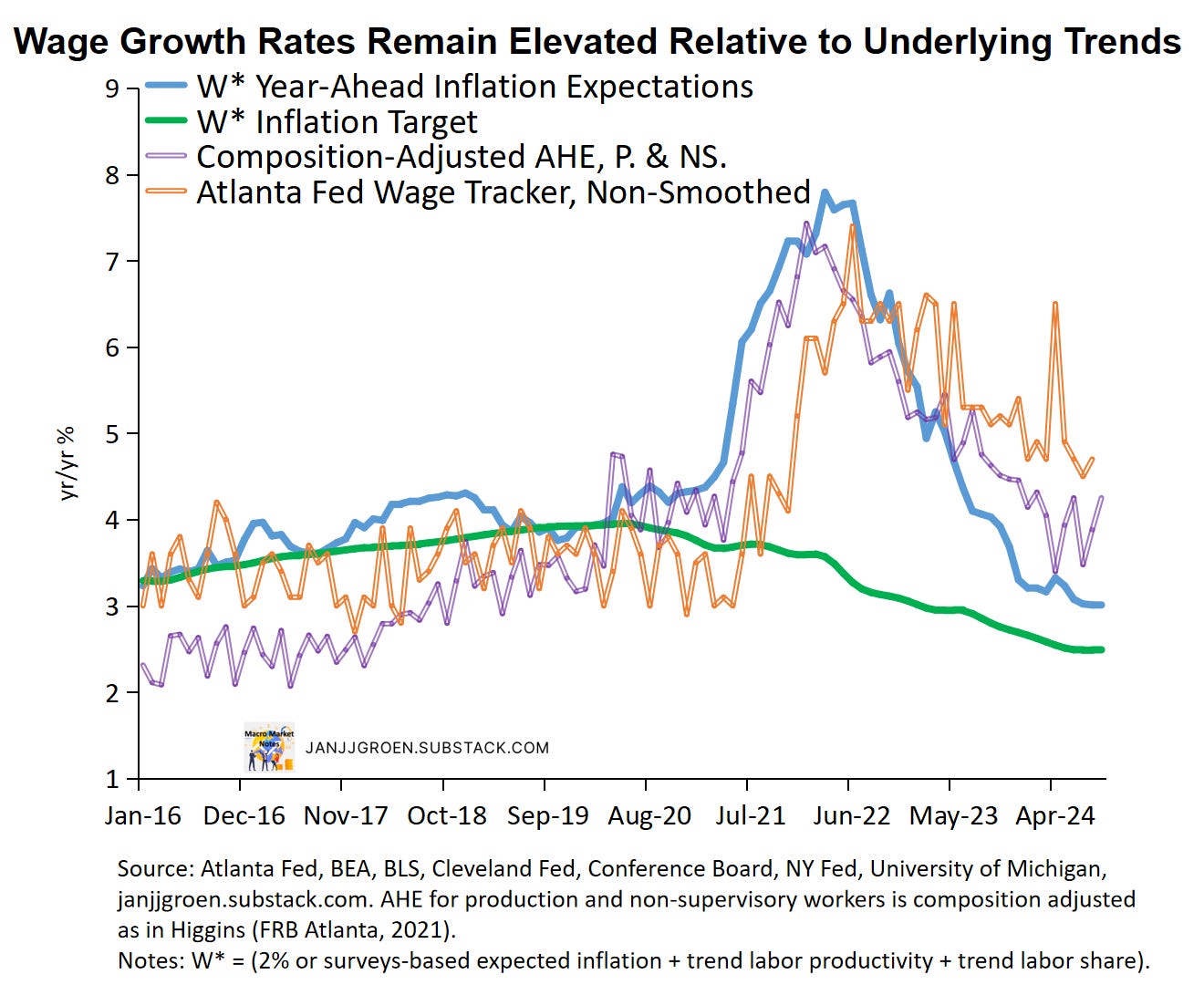

Wage growth in composition-adjusted average hourly earnings remains elevated at paces inconsistent with both the 2% inflation target and near-term inflation expectations.

Today’s data seems in line with the Fed’s outlook for the labor market and thus suggests a gradual easing of the future policy rate path.

September Jobs Growth: Accelerating Again

The September jobs report released today indicated that payrolls in the establishment survey surprised markedly to the upside as they were up by 254,000 persons in September, compared to a 159,000 increase in the preceding month (which was revised up from 142,000 initially). Payrolls growth for July and August combined were revised up by 72,000 persons.

The unemployment rate dropped 0.1 percentage point to 4.1% in September. In three-digit terms the unemployment rate went down notably more from 4.221% in August to 4.051%. Household employment grew faster in September: from +168,000 persons in August to +430,000 persons (chart above). The labor force grew by 150,000 persons, less than a population growth of 224,000 persons in September with the labor force participation rate remaining at 62.7% for the third consecutive month.

Moving beyond the month-to-month movements, the chart above shows three- and six-month moving averages of payrolls changes from the establishment survey since February 2022. Smoothed trends in payrolls growth recently edged up again after slowing over the summer. Nonetheless over that period the smoothed trends appeared to outpace the breakeven pace needed to keep the unemployment rate constant in a given month (purple line in the above chart). This does not change after naively incorporating the results of the Preliminary Benchmark revision published in August, as I did recently (blue and orange dashed lines in the chart above).

Note that the estimate of the breakeven pace that keeps the unemployment rate constant in a given month is conditional on the BLS’ population growth estimates as well as the labor force participation rate in that month. There’s been a lot of public discourse on the validity of the population growth projections from the U.S. Census that are used by the BLS for its own population estimates. In particular when it comes to net immigration projections the Census has been criticized a lot. For example, the CBO’s population projections assume more aggressive net immigration numbers for 2023 and 2024, resulting in noninstitutionalized population estimates of about 268 million in 2023 (vs about 266 million from Census) and about 271 million in 2024.

In the chart above I have recomputed the breakeven payrolls growth pace for a constant unemployment rate, by adjusting the BLS’ population projections for 2023 and 2024 such that they are line with the CBO’s 2023 and 2024 noninstitutionalized population estimates (gray line in the chart above). By comparing the trends in (revised) payrolls to this revised breakeven pace it’s clear that job creation in the U.S. this year had a hard time to keep up with this revised breakeven pace. Especially over the summer payrolls growth seems to have fallen behind, which is in line with the acceleration in the unemployment rate over this period. Since August, however, payrolls growth appears more in line with the CBO-implied breakeven pace of around 192,000 persons in September1 (vs. about 113,000 using the BLS population estimates). An indication that the labor market likely is stabilizing in line with a 4%-4.2% unemployment rate.

Additional details about the underlying strength of the labor market can be inferred from the household employment survey. Following Shimer (AER, 2005) and Shimer (RED, 2012), we can use data on total unemployed and employed persons as well as the number of people that are unemployed for less than 5 weeks to estimate:

Job-finding rate: the probability an unemployed person in month t will find a job or leaves the labor force. This is calculated assuming that total unemployment in month t+1 equals month t unemployment plus the number of people unemployed for less than 5 weeks in month t+1.2

Job-exit rate: the likelihood an employed person in month t will exit its job either due to layoffs, quits or retirement, which depends on data on the job-finding rate, unemployment and labor force.3

The chart above shows a plot for the estimated job-exit rate. This job-exit rate has been relatively stable over the past two years, with a moderate downward shift in the first half of 2023 that stabilized between June and October, but then rose again until recently, as layoffs and retirements picked up. Note, however, that the y-axis in the chart above also makes clear that the variability in the separation rate has been really modest.

Job exits jumped up between June and August and but moved down notably between August and September (chart above). The ratio of job exits is now at the lowest level since early 2024.

In 2023 the job-finding rate declined a lot after Q1 2023 (chart above) but recovered to about 54% on the month and 52% on a three-month average basis in December of that year. However, in 2024 the job-finding rate declined again and continued to do so until June going into July when it stabilized around a low 43%, followed by an increase to about 52% between July and August.

In September the total number of unemployed persons declined for the second consecutive time over the month, but the number of newly unemployed persons (less than 5 weeks in duration) declined even more: -281,000 vs. -322,000. This suggests that the likelihood to exit unemployment between August and September declined somewhat, with the job-finding rate decreasing from about 52% to about 49% for August going into September (chart above). Three- and six-month averaged job-finding rates for August into September settled at around 48%.

As in Shimer (AER, 2005) we can combine the above discussed job-exit and job-finding rates to calculate a flow-consistent unemployment rate and the chart above plots both the corresponding monthly rate and the three-month average of this rate. The (three-month average) flow-consistent unemployment rate is the unemployment rate that prevails when the job-exit and job-finding rates remain constant at their current (three-month average) levels. Deviations compared to the official unemployment rate should dissipate over time, and often leads changes in the official rate.

The chart above shows clearly that the improvements in the job-exit and job-finding rates between July and September led to a drop in the monthly flow-consistent unemployment rate to levels not seen since the start of the year. And as these now run well below the official unemployment rate, this suggest there is some downside risk to the outlook for the official unemployment rate next month.

Given the choppiness in this measure it’s probably more useful to look at three-month averages. Since January the flow-consistent unemployment rate on a three-month average basis has been outpacing the official unemployment rate and leading the rise in the latter (solid blue and orange lines in the chart above). This was largely driven by a deterioration in the job finding rate over that period, which reflects labor demand weakening. More recently, however, three-month averages of headline and flow-consistent unemployment rates suggest that over the near term the unemployment rate will likely stabilize around 4.2%.

Once taking into account higher-than-expected population growth, the establishment and household surveys paint a fairly similar picture of the labor market: (a) smoothed flow-consistent unemployment rates stabilizing around 4.2%, (b) trends in payrolls growth running close to revised breakeven paces consistent with an unemployment rate in the 4%-4.2% range. So, it appears the labor market is settling into new steady state after adapting to a higher-than-expected labor force growth earlier in the year.

Wage Growth Remains Elevated

Average hourly earnings of all private sector employees grew slightly less fast over the month in September at 0.4% month/month from an upwardly revised 0.5% in August and increased substantially in year/year terms from (an upwardly revised) 3.9% in August to 4.6%. For production and non-supervisory workers, hourly earnings went up at 0.3% month/month in September, a broadly similar pace as in July and August, and on a year/year basis growth accelerated from 4.1% to 4.4% in September.

The wage data from the jobs report are notoriously noisy, given that they are revised often and do not correct for the sectoral and skills composition of jobs growth over the month. There are better quality wage data available, such as the Atlanta Fed Wage Growth Tracker and the Employment Cost Index, but the Atlanta Fed does construct a rudimentary composition correction for average hourly earnings from the jobs report, which can be found here.

We can observe from the chart above is that the year/year wage growth rate indeed picked up in pace, despite the composition correction, although on a three-month basis composition-adjusted wage growth eased slightly.

I can combine labor productivity and labor share trend estimates with the 2% inflation target, along the lines I have done in my “Wages and Inflation Expectations” notes and incorporating the Q2 update of productivity data to get a medium-run annual wage growth rate consistent with 2% inflation. Additionally, instead of the 2% target one can use my “Main Street” year-ahead inflation expectations proxy, which after incorporating September inflation survey data suggests that the trend in near-term inflation expectations eased since Q2 to around 2.5% in year/year PCE inflation terms in September.

Compared to both the composition-adjusted AHE data for production and non-supervisory workers and the unsmoothed Atlanta Fed wage tracker into August, annual wage growth rates still outpace the 2.5% pace consistent with 2% PCE inflation in the medium term (green line in the above chart). In fact, wage growth also runs above the wage growth pace consistent with “Main Street” near-term inflation expectations (blue line in the chart above).

November Rate Cut

After the conclusion of the September FOMC meeting the Fed clearly signaled that the 50bps rate cut following that meeting was nothing more than a recalibration move, and that it would ease policy rates at more moderate pace beyond that meeting. This was based on the notion that the U.S. economy was on a moderate growth path with a labor market cooling towards a steady state with unemployment rates in the low 4% range and inflation that continues to ease back towards 2% over time. Today’s data corroborates the Fed’s view on the labor market, with unemployment rates seemingly stabilizing in the 4%-4.2% range.

As such I expect a 25bps rate cut at the November FOMC meeting and likely a similar rate cut at the December FOMC meeting. As employment growth appears to be evolving in line with the Fed’s own view and wage growth remaining stubbornly elevated, there’s likely no appetite amongst FOMC members to pursue more aggressive rate cuts.

Given this calculation, the job-finding rate will run up to August utilizing data on (short-term) unemployment for September.

As the calculation of the job-separation rate depends also on (short-term) unemployment for September, we cannot go beyond August.