Feb Personal Income & Outlays: A Mean-Reverting Consumer?

Personal wage income and underlying real spending stabilized with the latter suggesting a slowing in near-term spending. Services inflation remains elevated.

The February Personal Income and Outlays report provides a good insight on the U.S. consumer as well as inflationary pressures going forward. This note presents some of these insights.

Key takeaways:

Personal income growth out of wages and salaries stabilized in February and still outpaces the growth rate that is consistent with 2% PCE inflation over the medium-term.

The stock of excess savings has NOT run out and continues to be a tailwind for consumption. Between January and February, it fell around $36 billion and equaled about $564 billion in February.

While Real PCE growth accelerated, the underlying (trimmed mean) growth rate ran at a slower pace than the headline rate in February. This suggests that consumption will slow in H1 2024 but likely due to a reversal back to trend rather than an economic slowdown.

Core services excl. housing PCE inflation, the Fed’s favorite gauge of underlying inflation, remains at elevated levels. More boarder based underlying inflation measures accelerated since late 2023 and moved further above the Fed’s inflation target.

Despite slowing underlying momentum in real spending, still solid growth rates of wage income and spending as well as elevated non-housing core services inflation will mean the Fed remains wary of starting to cut rates too early in 2024.

Wage Income Growth Remains Solid.

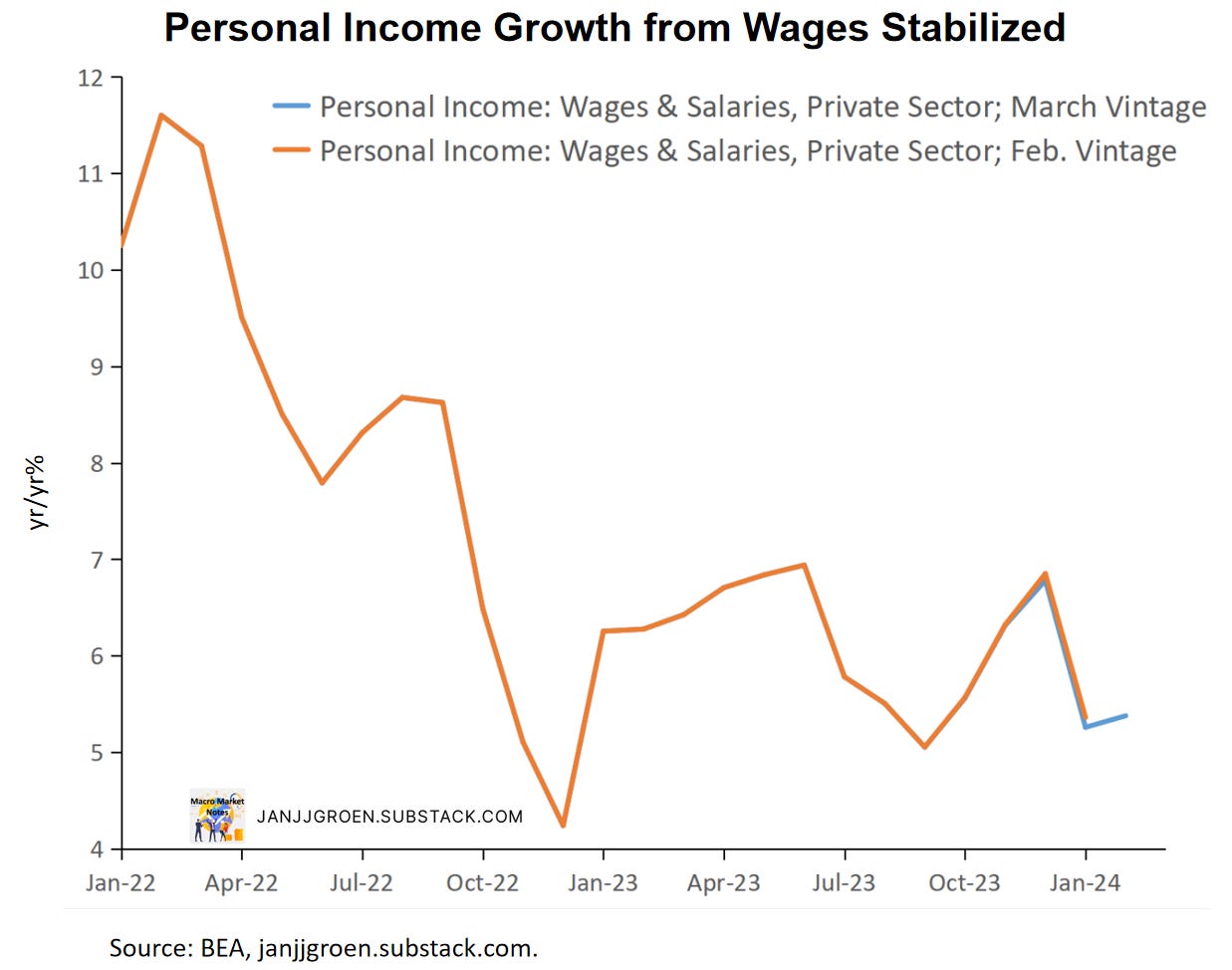

A dominant source of household income is personal income out of wages and salaries. Today’s report showed essentially no revisions in the recent growth of household income out of wages and salaries throughout H2 2023.

The year/year growth rate in February recovered slightly compared to January (chart above), as it went up to 5.4% from 5.3% (revised down from 5.4%). Note that overall personal income growth slowed from 4.9% in January to 4.6% year/year, implying that growth of non-wage income (interest and dividend income as well as government transfers) took a step back in February.

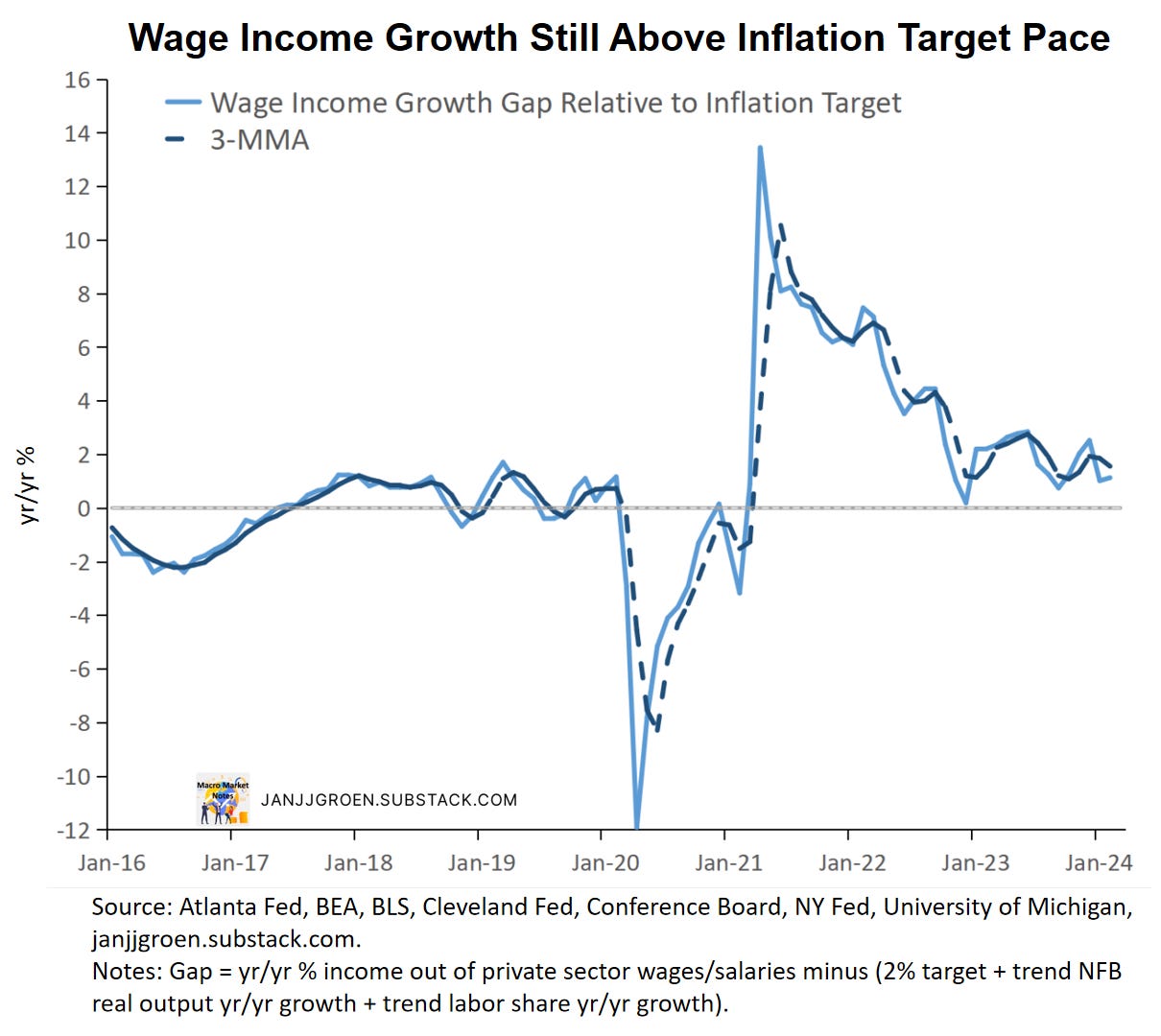

To interpret wage income growth trends, I earlier proposed to compare wage income growth with a neutral benchmark growth rate based on trend non-farm business sector (NFB) output growth and either the abovementioned common inflation expectations factor or the 2% Fed inflation target. Similar to what I did when discussing wages and inflation expectations in my October update, I now also incorporate trend labor share growth into this neutral benchmark.

Any deviation in actual household wage income growth above or below the aforementioned the inflation target-consistent neutral benchmark means household wage income growth outpaces or cannot sustain in the medium term the 2% inflation target.

The chart above shows that momentum in the wage income growth gap based on the Fed’s inflation target picked up again from about +1 percentage point to about +1.1-percentage point, with the three-month averaged version running at about a +1.6-percentage point gap. Hence, nominal wage income growth continues to run at a pace that remains too high to be able to bring inflation back to target in the medium term.

Earlier I showed that the common trend across near-term inflation expectations of firms and households has eased towards the end of 2023 and currently sits at a year/year PCE inflation equivalent rate of 2.7%. Given the gap between personal income out of wages and the medium-term benchmark consistent with 2% inflation, the personal wage income growth pace is also overshooting the medium-run pace that would be consistent with this 2.7% inflation expectation rate. Elevated wage income growth therefore remains an upside risk to the medium-term inflation outlook.

With household income growth out of wages and salaries still running above the pace consistent with 2% PCE inflation this might be a sign that households’ incomes are likely to remain strong enough to keep consumption spending elevated.

Pace of Excess Savings Drawdowns Remain Gradual

Household spending was up 0.8% over the month in February, a considerably higher pace compared to disposable household income growth of 0.2% for the same period. As a consequence, the savings rate declined from 4% in January (upwardly revised) to 3.6% in February.

The chart above shows that the savings rate remains below my trend savings rate estimate of 5.4% (down from an unrevised 5.7% in January) using the ‘average of trend’ approach outlined in my earlier excess savings note (orange line). The actual savings rate had been diverging to the downside relative to this trend savings rate estimate since May 2023, but a lot less so compared to trend savings rate assumptions used elsewhere (grey and yellow lines).

Given the earlier discussed revisions to both personal wage income growth and my estimate of the trend savings rate, in February cumulative excess savings declined from $600 billion in the previous month (upwardly revised from $561 billion) to about $564 billion (see chart above).

Note that also in the chart above that for the first time since March 2020 interest payments have now become a source of excess savings drawdowns in addition to consumption spending. Hence, going forward with high interest rates having more of an impact on household budgets we can expect a somewhat faster pace of excess savings declines. Nonetheless, above-trend growth in disposable income continues to be a partial offset the drawdowns in excess savings coming from above-trend growth in consumption spending and interest payments.

Trend Pace in Consumption Spending Stabilized

Strong income growth out of wages in 2023 allowed households to keep spending at a robust pace without the need to completely run down the stock of excess savings. With wage income growth remaining above inflation target pace, this could mean that real consumption expenditures can be expected to remain relatively high for the near term.

As is the case with headline inflation, headline real consumption spending growth often is driven by volatile components that not always reflect the underlying strength of the economy. A core real consumption spending growth measure, therefore, would be really useful, and I do that by approximating such a core measure based on constructing a weighted trimmed mean across 177 components1 of headline real personal consumption expenditures (PCE). This trimmed mean measure provides a more accurate reading on the underlying strength of the economy than headline real PCE growth rates, with the trimmed mean measure decreasing ahead of headline growth before the onset of a recession.

When we focus on the most recent period as in the chart above, the six-month annualized headline real PCE growth was basically in line with the trimmed mean six-month growth rate throughout 2022. That changed in 2023 trimmed mean real PCE growth outpacing headline growth, with the gap between the six-month annualized growth rate of trimmed mean real PCE and that of headline PCE growing since September.

In January, however, the headline and trimmed mean growth rates gap shrank and in February headline growth overshot the trimmed mean measure, as the latter remained broadly unchanged in February after it declined in January. This in itself suggests that going into Q2 2024 we should expect real consumption spending to slow down. There are two reasons to not to be too concerned about this near-term spending slowdown just yet:

Bad weather likely led to suppressed spending in January and the February pick up in real consumption likely partially reflects a bounce back from this bad weather impact.

The trimmed mean real spending growth rate stabilized in January-February at a pace similar to that observed at the start of 2023, which was still well above the underlying spending growth rates seen in 2022 (blue line in the chart above).

Historically, three to four months ahead of a recession the 6-month trimmed mean consumption growth rate starts to decelerate faster than the headline consumption growth rate (chart above). Currently, we’re not in that type of scenario just yet. The current slower pace of trimmed mean real PCE growth relative to the headline growth rate likely means consumption will slow going into Q2 2024 as consumption growth reverts back to historical trends but does not signal an economic slowdown.

Still Elevated Underlying Inflationary Pressures

In terms of inflation, core PCE inflation slowed in February to a 3.2% annualized monthly rate from an upwardly revised 5.6% rate in January. Core goods inflation accelerate to 3.8% annualized month/month from -0.6% in January, whereas core service inflation decelerated to about 3% annualized month/month in February from 7.8% in the preceding month.

The Fed’s favorite gauge of underlying inflation, core services excl. housing PCE inflation was a main driver behind the February core service inflation deceleration, as it slowed from (an upwardly revised) 8.2% annualized month/month to about 2.2%. Given the large volatility in this measure since late 2023 it seems worthwhile to smooth through noisy month-over-month dynamics.

The chart above plots three-, six- and 12-month annualized inflation rates for the non-housing core services PCE deflator. The average annualized monthly rate still reads about 4% for the post-COVID era (black dashed line), two times the average rate we observed for the immediate years pre-COVID.

The momentum measures in the chart above have been sticky around 4% for most of 2023. But in Q4 2023 momentum in core services excl. housing PCE inflation appeared to ease in a tentative sign that it might finally start to break free from the post-pandemic 4% trend. However, the January data at least partially reversed this disinflationary trend, and this remains the case for February.

Indeed, a similar conclusion can be drawn if we look at more broadly defined measures of underlying inflation trends. The chart above plots six-month average of the annualized percentage point deviation of monthly median CPI, trimmed mean CPI median PCE and trimmed mean PCE inflation rates relative to their values as implied by 2% core PCE inflation. While a lot of progress was made in 2023 in terms of return back towards the Fed’s 2% inflation target, this reversed since late 2023. Another sign of caution for the Fed.

With households’ wage income growth still supportive of above-target PCE inflation over the medium term and a solid labor market, conditions continue to be in place that could slow down the disinflation in the core services sector. On the other hand, a slower pace of underlying real spending growth suggests consumption might revert back to trend soon, which could help the disinflation process. It is clear the Fed will want to carefully assess the data before commencing a rate easing cycle. Fed funds rate cuts thus are likely not be happening before June 2024.

For a description of these 177 components, see Appendix A in the Dallas Fed trimmed mean PCE inflation working paper.